QUOTE OF THE WEEK

“It does not matter how slow you go as long a you do not stop.” – Confucius

TECH CORNER

Last month we had a slight increase in interest rates resulting in a small decline in bond values. We currently own Treasuries and investment grade bonds at high interest rates. I expect we will be maintaining these positions for quite a while. These high interest rates should come down as we head into the recession which is good for us. Remember bond prices go up as interest rates come down.

We are still convinced that we are headed into a recession. It just isn’t here yet.

The stock market is of course not the economy, particularly when the Magnificent Seven “artificial intelligence” related stocks are up 49% while the other 493 stocks of the S&P 500 are only up around 2%. This same set of circumstances occurred in the Teck Bubble of 2000 to 2002 where any stock that in anyway was tied to the “new” internet roared up in value and the stock market eventually declined by 50% from the top to the bottom.

My favorite saying back then was if the company’s name was “No Revenue No Earnings.com” it would rise in value. This rise in the Magnificent Seven has not been driven by profit increases but rather by having Artificial Intelligence associated with the company. Those companies are up a lot. This rally is not broad, it is very narrow.

So far this year as to the stock market, it seems as though economic data doesn’t matter. But eventually gravity will win.

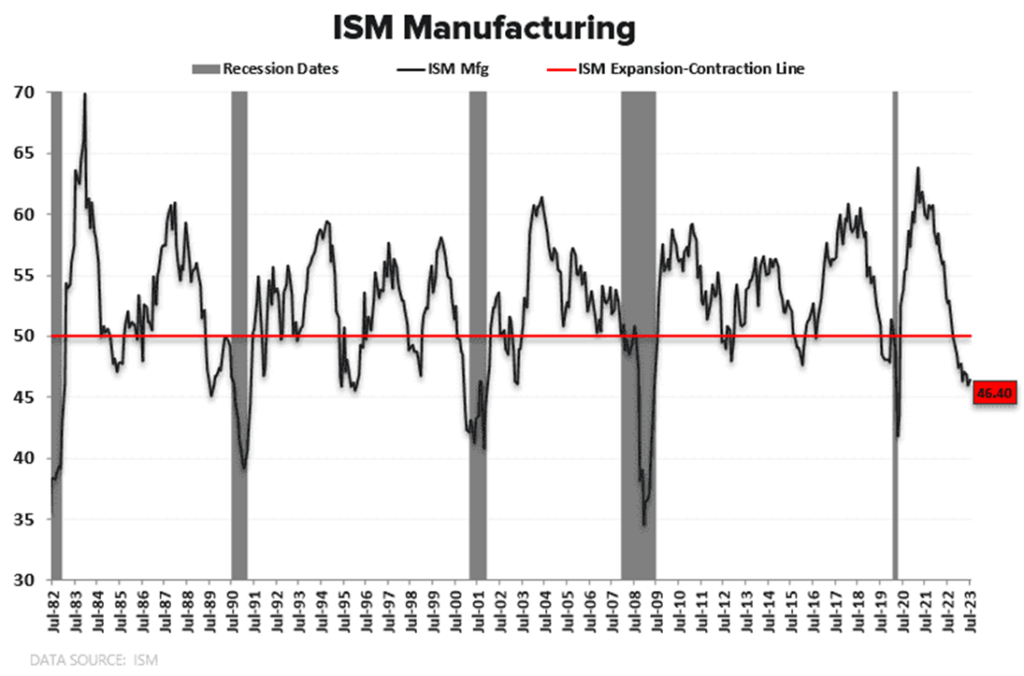

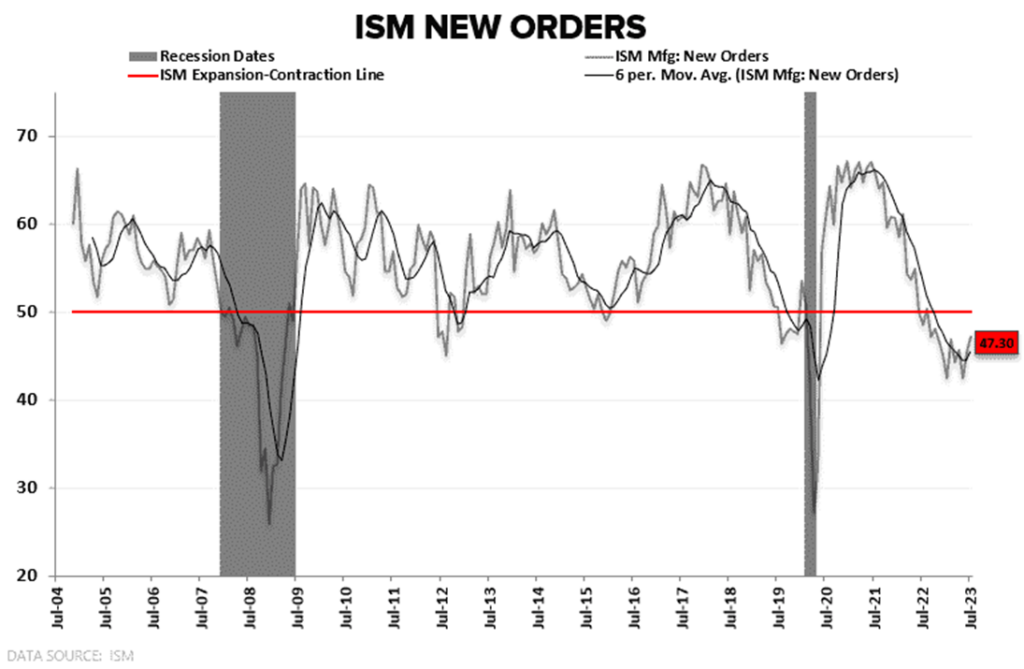

Here are a few of the latest data points for the economy:

China and European PMIs both slouched into deepening contraction. PMI stands for Purchasing Manager’s Index and are surveyed as to how much the companies are purchasing. This index is an excellent picture of the economy and if companies are not purchasing goods, that means the companies are expecting hard times ahead.

South Korean export growth made a new rate of change cycle low of -16.5% year over year in July. Remember the US is part of the global economy.

The Dallas Fed showed new orders declining to a fresh YTD low of -18.1%.

The Fed Senior Loan office survey of banks showed further tightening in lending and an accelerating contraction in demand for loans.

The Treasury increased its debt issuance target for the second half of this year to $1.85 trillion. Yes that’s right, this is just for the back half of this year with an annualized interest expense already at $1 trillion. And yes, that number reflects weaker-than-expected tax receipts and will get meaningfully worse if we fall into an outright contraction and tax receipts tank further. And yes, we don’t have the “cash” to pay that debt or the interest on it, so we will issue more debt just to pay the interest expense.

Going forward the data looks pretty gloomy for the economy. We shall see how it plays out. Due the fact we own high interest rate bonds I think we are in a good position to weather any storms that maybe coming. Safe is the operative plan going forward.