QUOTE OF THE WEEK

“Between stimulus and response, there is a space. In that space is our power to choose our response. In our response lies our growth and our freedom.” – Vicktor Emil Frankl

TECH CORNER

Nothing has changed over the last week as far as the economy is concerned. It is still just barely hanging on before it goes into a recession which I am surprised that it is taking so long to do so.

Just a few indicators confirming the declining economy:

Credit card delinquencies (losses) for the banks are at the fastest pace in 30 years.

Trucking employment is down 30%. These are the people that bring us the goods that we consume.

Retail sales were up 7% last month, however leverage is driving the increase with personal savings declining and credit card balances increasing. This has been happening every month since May.

Personal savings of consumers is less than what they were pre-pandemic.

I could go on and on.

The following is an interesting article from “The Real Economy” written by Tuan Nguyen about consumer sentiment declining. If the consumer is discouraged that will effect 70% of the U.S. Economy.

Consumer sentiment hits 5-month low amid elevated inflation expectations

OCT. 13, 2023 BY TUAN NGUYEN

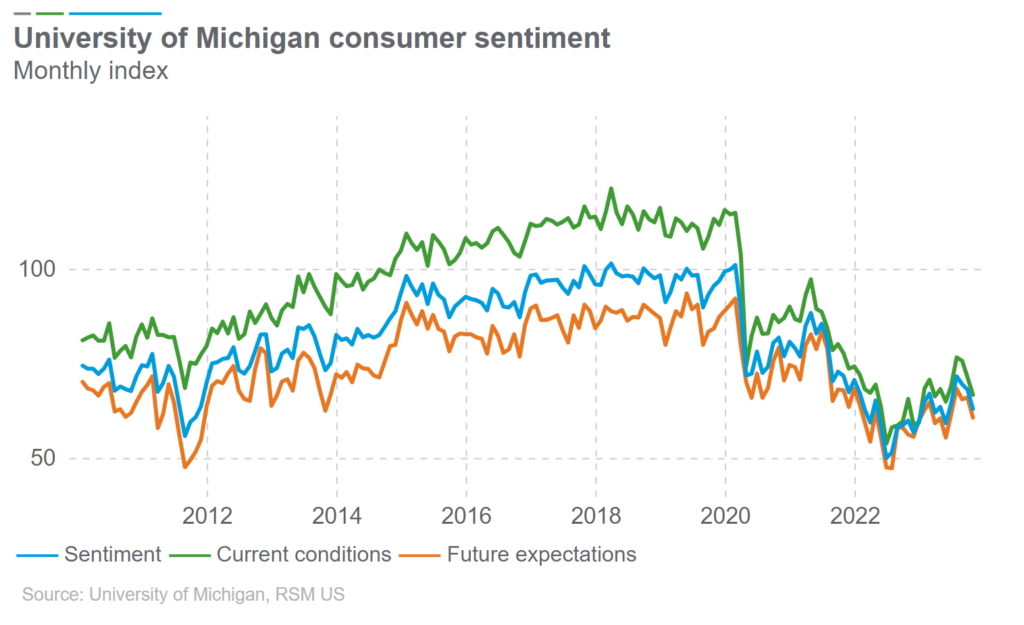

Consumer sentiment this month dropped to the lowest level since May, according to preliminary October data in the University of Michigan survey released Friday. The decline stems from the rebound in inflation, high gasoline prices and weakened expectations due to a looming government shutdown.

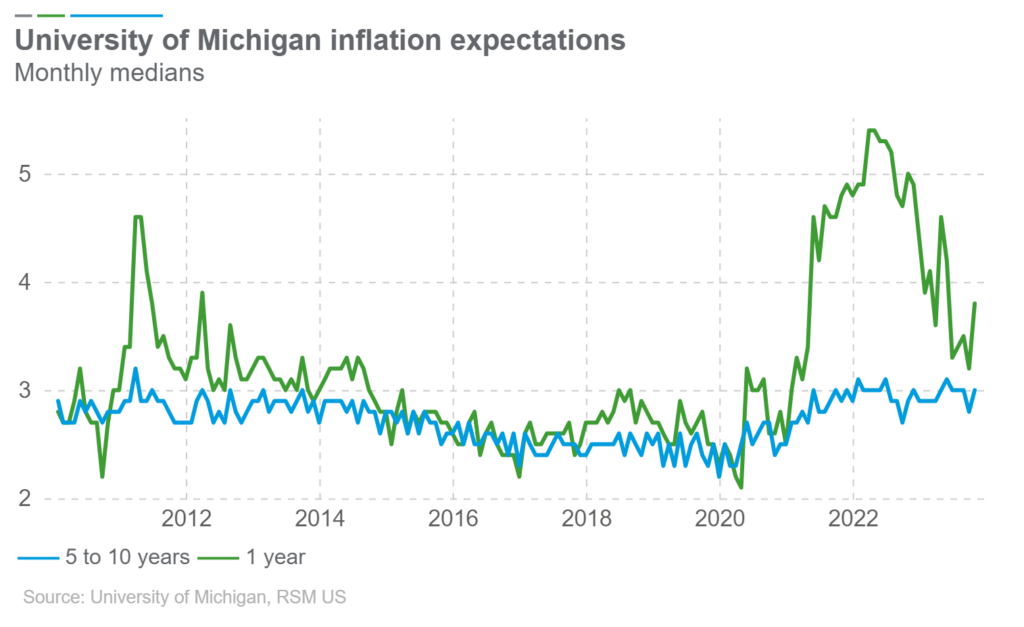

More concerning is the sharp increase in inflation expectations, which should add some pressure on the Federal Reserve ahead of its November meeting.

The sentiment index fell to 63 in October from 68.1 in September. Meanwhile, the 12-month inflation expectation rose to 3.8% from 3.2%, and the 5-to-10-year expectation rose to 3.0% from 2.8%, according to the University of Michigan survey.

Clearly, rising prices at the pumps and headline Consumer Price Index (CPI) inflation staying at 3.7% for the last two months have had a significant impact on consumers’ inflation outlook.

This is definitely not good news for the Fed as it tries to engineer a soft landing, possibly without any more rate hikes this year.

Consumers are down on most sentiment subindexes, from finances to income and job prospects. However, when asked about spending plans, survey respondents did not indicate any change in buying intentions for major items. They are down slightly for buying a new car and even less so for buying a new house.

To be clear, consumer sentiment about household balance sheets remains solid when compared to the last five years and even the next five years. That is more in line with our new estimate of excess savings: There are about $400 billion left in the economy that should be able to fuel spending and growth at least until the first quarter of 2024.

But the outlook for consumer sentiment might face more risks going forward. Geopolitical conflict in the Middle East could cause periodic volatility in oil and energy markets with varied second-order effects on domestic gasoline prices. While the conflict’s impact on energy prices remains limited at the moment, it is critical to keep monitoring the spillover effect the longer the conflict lasts.