QUOTE OF THE WEEK

“I’ve learned that you can tell a lot about a person by the way he handles these three things: a rainy day, lost luggage and tangled Christmas lights.” – Maya Angelou

TECH CORNER

The month of November was a really good month for the stock markets and investors seem to think that we will have a soft landing or no recession at all. Sorry, all the data points to a recession coming soon and it could be deep if the trends of the data continue. Last month was also a good month for the bond market which was good for our portfolios.

One factor pointing to a recession is the fact that many Americans are plagued with debt. Credit card debt has eclipsed the $1 trillion mark for the first time ever. Household debt is at a record high and interest rates on that debt is also continuing to rise.

During the first few years of the COVID-19 pandemic, Americans were socking away some major savings which actually exceeded over $2 trillion dollars. Stimulus checks were bringing in extra income, student loan repayments were on pause and isolation measures ensured folks saved on their work commute, coffees and they spent less on things like travel and dining out.

But when the restrictions were lifted, many consumers made up the lost time by splurging on luxury items, concert tickets, eating out and travel. Because they had a big cash cushion, people spent more than they normally would. Sort of like a rebounding spring effect. This spending helped push inflation higher.

However, since then, 80% of Americans have run out of their extra savings, and have borrowed on their credit cards to finance the excess spending. They now have less cash on hand than they did when the pandemic began.

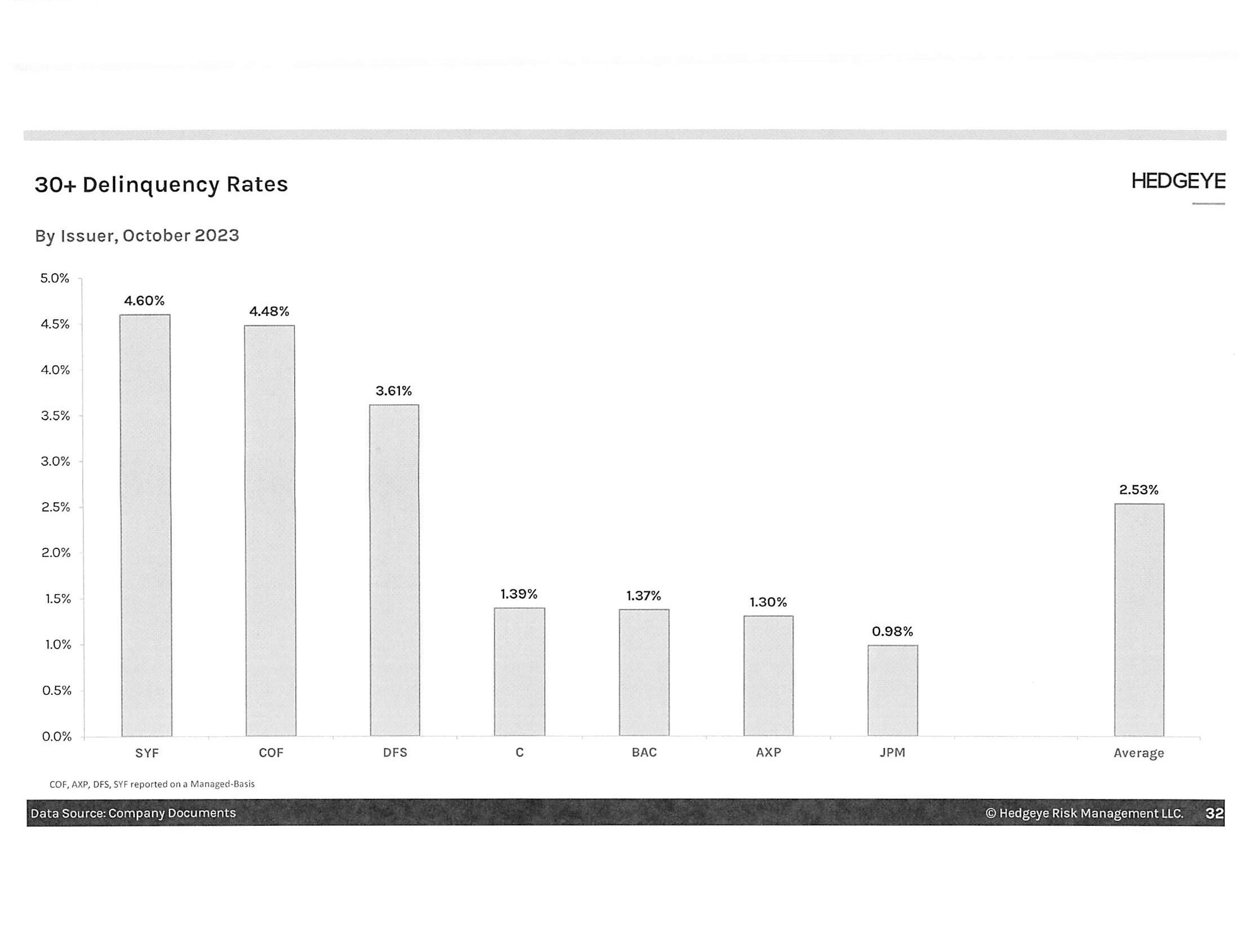

The graph below shows the percentage of 30 day plus delinquency rates for the major credit card issuers. The average is at 2.53% and rising. Most consumers have run out of money and they are still spending at an unsustainable rate using credit cards to finance their debt.