Quote of the Week

“Successful people are not gifted; they just work hard, then succeed on purpose.”— G.K. Nelson

Tech Corner

Last week was a great week for the markets, and we took full advantage of it across our managed model, Variable Annuities, and Variable Life Insurance Contracts. The Dow was up +3.89%, the S&P 500 was up +4.65%, the Nasdaq was up +6.01%, and MSCI-EAFE was up +1.96%. The Dow is up +1.77% for the year, the S&P 500 is up +3.48%, the Nasdaq is up +7.51%, and MSCI-EAFE is up +0.85%.

This week the markets are up only slightly, which is expected after such a great run last week. Our market data signals are slowing, and we have taken some profits off the table as a result. Because we are still firmly in Quad II, we expect the markets to continue to rise but not in such a dramatic fashion as last week. We shall see what happens going forward, but we want to protect our gains, so I have one foot slightly out the door just in case.

U.S. employment remains lackluster. We added 49,000 new jobs in January. Not so hot, but OK considering the environment we are now in with businesses that require face to face interaction taking the biggest hits. Unemployment dipped to 6.3%, but that is a bogus number as 400,000 people dropped off the rolls only because they stopped looking for work.

The Biden administration is working hard with allies in Congress to pass another stimulus program. The Biden stimulus provides for additional payments to individuals and extending the Federal contribution to unemployment into the fall. Supplemental help to municipalities is also in the package. This help to municipalities is a no-go for the Republicans, where we are already starting to see layoffs.

It looks like Mr. Biden will push this package through no matter what, even if he has to use the Reconciliation process, which only requires a simple majority in the Senate. Whether this is the correct move to make probably depends on your political preference. Time will tell if the package’s size is the right thing to do; however, we see it as a considerable stimulus to the stock markets.

The potential stimulus seems to forestall additional economic damage until the vaccine can allow individuals to interact more with each other. The Biden administration targets an additional $1,400 in direct payments to a slightly smaller group than those supported by previous packages. I fully agree that wealthy people with lower incomes should not receive these checks.

Hidden in all the drama the last two weeks, the Federal Reserve assured investors the Federal Funds Rate would remain favorable for an extended period. The Fed left rates near 0% and remains committed to purchasing government bonds to keep long-term rates lower until the economy improves and is on solid ground.

The one thing that would be a kick start to the economy, and for many parents’ mental health, would be to get the schools open as soon as possible. Spend the money to make it happen.

Larry’s Thoughts

The Real Economy Blog is one of my favorite sources that I subscribe to. I hope you find their current analysis of the employment situation informative.

U.S. employment report: A weak gain in jobs and a nonvirtuous decline in the jobless rate to 6.3%

FEB. 5, 2021 BY JOSEPH BRUSUELAS

The intense debate over whether there needs to be a large fiscal stimulus package was supplemented by a weak U.S. employment report for January that saw an anemic gain of 49,000 jobs while 406,000 people exited the workforce.

That exodus of workers was the primary catalyst for a decline in the unemployment rate to 6.3% announced by the Labor Department on Friday.

The jobless rate fell to 6.3% mainly because 406,000 people left the workforce.

Our pandemic-induced estimate of the unemployment rate implies a minimum rate of 7.5%, which we readily acknowledge is likely much higher – as much as 1% – because of those who have dropped out of the workforce and face significant durations of unemployment.

This all suggests that a robust policy effort needs to be put in place before fiscal fatigue sets in and constrains the ability of policymakers to act.

On the heels of the downward revision of the December report to a loss of 227,000 jobs, this data strongly supports the arguments of those who recommend that the next round of policy aid be large, bold and sustained.

One cannot look at this data and argue that robust fiscal aid is going to result in inflation or a major shift in interest rate policy by the Federal Reserve. In fact, it tends to underscore the Fed’s recent statements that strongly imply the need for robust fiscal action and a zero interest rate policy until 2024.

The January report also brings to a close the Trump-era data on the domestic labor market that ends with a whimper and not a bang. The U.S. economy is short 2.9 million jobs relative to where it was in January 2017.

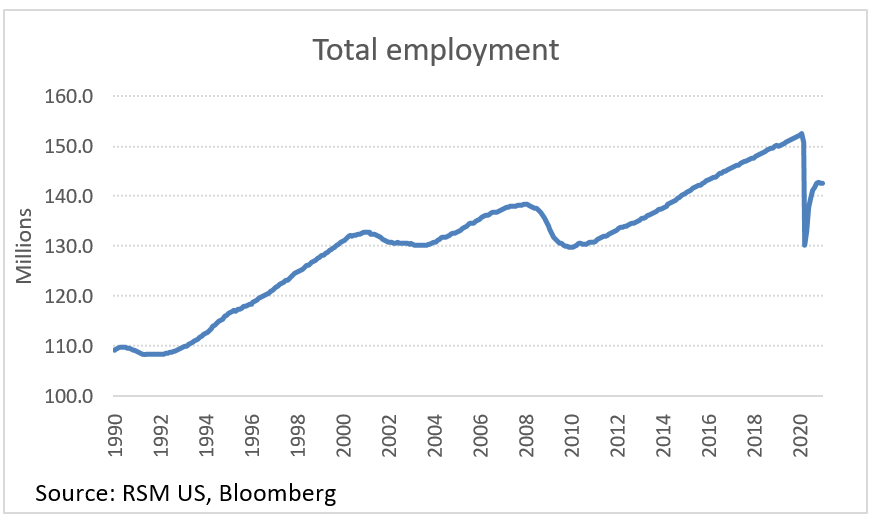

Economic historians will have plenty of grist for the mill on whether enough was done early in the pandemic to prevent what was a labor market catastrophe in March and April when nearly 22.4 million people lost their jobs. Following the revisions to the Bureau of Labor Statistics survey, the U.S. economy is short by about 9.9 million jobs relative to the peak last February.

Beneath the headline, this is a weak jobs report. Outside the gain of 97,000 jobs in business and professional services, of which 81,000 were temporary positions, it is hard to make the case that the labor market is experiencing a robust recovery.

Outside of that category, the other major high-paying sectors all experienced modest declines. Goods-producing jobs declined by 4,000, construction by 3,000 and manufacturing by 10,000.

While private service-providing jobs advanced by 10,000, mostly because of the increase in temporary hiring, there was a loss of 50,000 positions in trade and transport, 38,000 in retail trade and 61,000 in leisure and hospitality. The information sector added 16,000 workers, financial workers increased by 8,000 and the government added 43,000 workers to start the year.

Average hourly earnings increased 0.2% in January and are up 5.4% on a year-ago basis. But this is a function of compositional effects because of lower-end workers losing jobs and higher-end workers getting compensation increases in the new year. This data should not be construed as a risk to the inflation outlook through the wage channel.