QUOTE OF THE WEEK

“Jump and you will find out how to unfold your wings as you fall.” – Ray Bradbury

TECH CORNER

I found this on my Phone:

The ambitious mind can view progress on binary terms:

* I don’t have an hour to lift, so I shouldn’t go.

* I don’t have four hours for deep work, so I shouldn’t start.

* I don’t have 30 minutes to call mom, so I shouldn’t call.

Never let optimal get in the way of beneficial.

First the news. Fed Chairman Jerome Powell just said in his comments the Fed is not going to raise interest rates at this time. He did say that he reserves the possibility to raise rates in the future if inflation goes up or doesn’t come down. Both the bond markets and the stock markets have rallied on his comments. My personal opinion is that this is just a relief rally.

Now for the other side of the coin let’s talk about the current data.

The ISM Manufacturing Index declined to 46.7 in October lagging the consensus expected 49.0. (Levels higher than 50 signal expansion; levels below 50 signal contraction.) A pretty bad trend.

The measures of activity were mostly lower in October. The new orders index declined to 45.5 from 49.2 in September, while the production index fell to 50.4 from 52.5. The employment index dropped to 46.8 from 51.2 in September.

The prices paid index rose to 45.1 in October from 43.8 in September (inflation increasing).

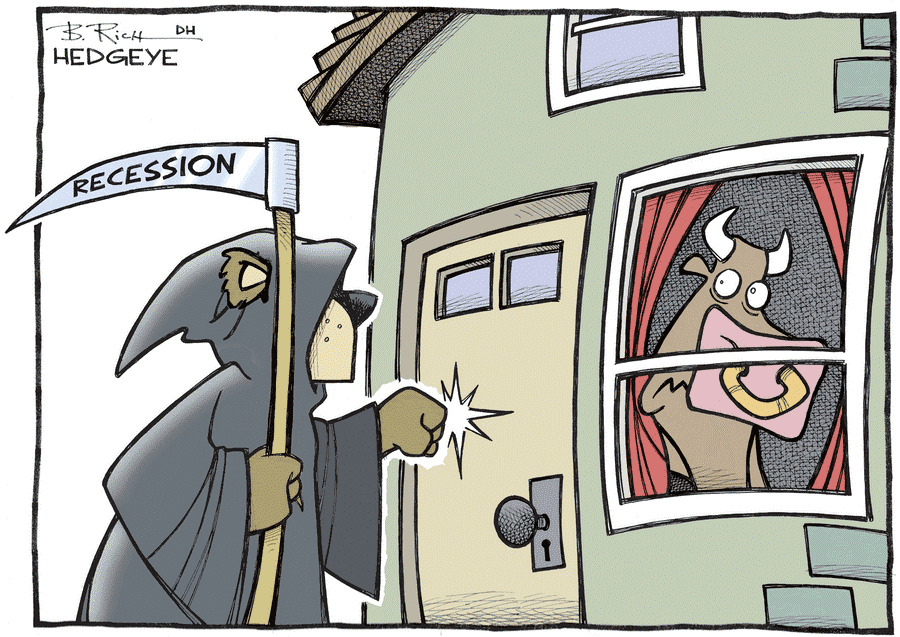

What are the implications of these statistics? Activity in the US factory sector contracted in October and has done so every month in the last year. We continue to believe a recession is lurking ahead and the details of today’s report suggest the goods sector of the economy is likely to lead the way. Just two out of eighteen major industries reported growth in October. Survey comments cited weakening demand, slowing activity, and declining optimism for 2024. Weakening demand was most easily seen in the new orders index, which remained in a downward trend for fourteen consecutive months.

In the managed accounts we are positioned in Money Market and ultra short term Treasuries. We are waiting in a safe position for a trend indication. All four of the major stock indexes have broken support and are in a declining trend.

6070743.1