Quote of the Week

“The remarkable thing is, we have a choice every day regarding the attitude we will embrace for that day.” – Charles R. Swindoll

Tech Corner

Last week all the markets were up a little over 1.00%. The first two days of this week, the markets gave up the gains of last week. It seems as though the markets are in a holding pattern or what we call a consolidation phase. We are still in Quad II which is good for stocks and commodities, so our positioning has not changed this year. While we have had a good year so far, it is frustrating that we haven’t broken out to the upside. We will continue to follow the process, which has been good for us.

There is a lot of good news in the economy. The recovery continues, with employment gaining momentum. Initial jobless claims fell below 600,000 for the first time since mid-March 2020. Retail sales surged 9.8% fueled by government stimulus.

The other bright sign going forward for growth stimulus is the wide scale distribution of the vaccines. Vaccinated people feel safe and are venturing out to restaurants, physical stores and making reservations for cruises and vacation spots—all good.

Manufacturing is also improving. However, it is hitting some headwinds due to supply chain challenges. We are experiencing many parts supply shortages, especially a microchip shortage. It is estimated that the microchip shortage will idle the manufacture of over one million cars this year. We just bought a new car. There are currently no shortages of new cars, so the dealership was not willing to bargain. “This is the price buddy, take it or leave it.” I didn’t realize it, but there are over 30 microchips on average in the new cars.

I am still encouraged that the markets will expand upward from here. The economy is too strong and will get stronger going forward.

Larry’s Thoughts

Over the weeks I have discussed the huge build up in personal savings. If we couldn’t go anywhere or do anything because of the pandemic, a natural outcome would be a growth in personal savings. With the virus getting under control because of the expansion of vaccinated people, the dam is about to break. It looks like we will soon be experiencing a spending “jailbreak.”

I hope you find this article interesting.

Robust rebound in March retail sales

APR. 15, 2021 BY JOSEPH BRUSUELAS

The combined impact of a weather-related resumption of household spending and $680 billion in fiscal aid checks working their way through the economy stimulated a robust 9.8% rebound in top-line March retail sales.

The control group, which feeds into the calculation of U.S. gross domestic product, advanced 6.9% and is up 27.5% on a three-month average annualized pace, according to government data released Thursday. It is important to note that retail sales comprise roughly 23% of the household spending aggregate that accounts for 70% of overall economic activity.

We think that the March report is the embarkation point for what will be an extraordinary year in American household spending that underscores our forecast of 7.5% growth in gross domestic product for this year and our 6.25% forecast for the first quarter.

Of the $1.9 trillion in fiscal aid embedded in the American Rescue Plan, roughly 75%, or $1.16 trillion, is designed to be spent this year, with $680 billion in aid front-loaded to jump-start household spending now.

We think that the March report is the start of what will be an extraordinary year in household spending.

The latest estimates by the Congressional Budget Office imply that $1.16 trillion in direct aid will reach its intended target households by the end of September, so this is not the last robust advance in retail sales.

One little-understood aspect of the American Rescue Plan is that half of the extension of the child tax credit will arrive in the form of monthly cash payments starting in the middle of the year—July was the original target date. These payments will bolster spending in general merchandise, goods and beverages, and health and personal care as families put that extra cash to work.

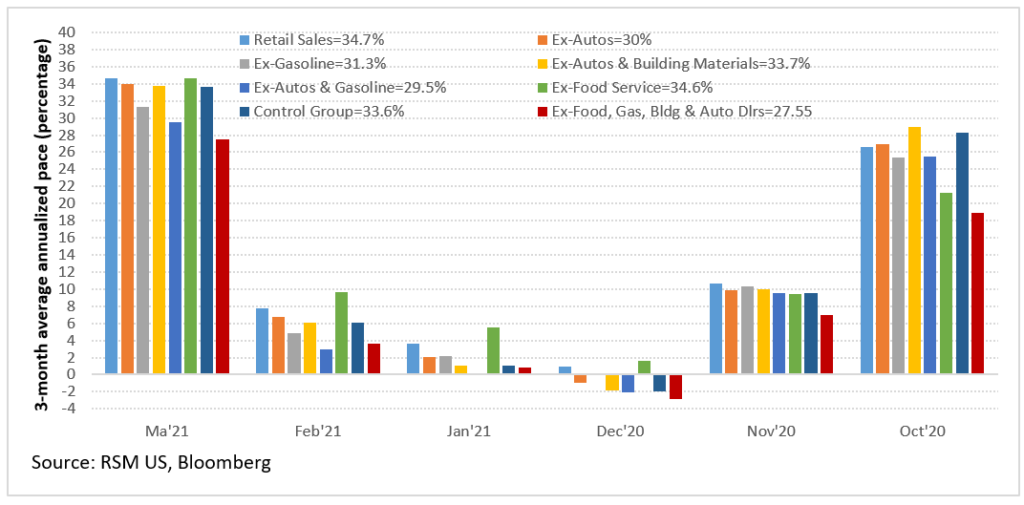

Because the monthly retail sales report tends to be full of seasonal noise, we focus on the spending at a three-month average annualized pace to ascertain the underlying pace of spending. But the large quantity of fiscal aid that is being pumped through the system has produced an outsized jump in that data. The top-line number implies a 34.75% increase in the three-month average annualized basis; the control group jumped 27.55%, ex-autos 34.5%, ex-gas 31.3% and ex-food service 34.6%.

The individual spending categories also advanced strongly. Outlays on motor vehicles and parts increased 15.1%, furniture 5.9%, electronics 10.5% and building materials 12.1%. The proxy for e-commerce, or spending at nonstore retailers, improved by 6%, outlays at eating and drinking establishments 13.4%, gasoline stations 10.9%, clothing 18.3%, sporting goods 23.5% and department stores 13%.

To give one a sense of the shock that American households experienced one year ago as the pandemic set in, a look at the year-over-year numbers are sufficient. Spending on clothing on a year-ago basis is up 104.65%, furniture 49.65% and sporting goods 78.25%. Overall retail spending is up 30.4%, while the control group is up 16%.

Take a look, folks, because we are likely not to see something like this again in our career arcs.

For more information on how the coronavirus pandemic is affecting midsize businesses, please visit the RSM Coronavirus Resource Center.

Brusuelas, Joseph. “Robust rebound in March retail sales.” Real Economy,

https://realeconomy.rsmus.com/robust-rebound-in-march-retail-sales/ Accessed 20 April 2021