QUOTE OF THE WEEK

“I do not at all understand the mystery of grace – only that it meets us where we are but does not leave us where it found us.” – Anne Lamott

TECH CORNER

Currently, the big debate is whether we will have a deep recession, a soft landing, or no recession at all. As Yogi Berra says, “It’s tough to make predications, especially about the future”. Janet Yellen our current Treasury Secretary is predicting a soft landing. The predications are all over the map. The issue comes down to how much the Fed’s interest rate increases affect the economy.

We never know what the effect will be until it happens. By raising interest rates in order to slow the economy and thus reduce inflation, we won’t know the result until time has passed.

The U.S. economy is skating on dangerously thin ice.

One outwardly negative headline could be enough to pour cold water on the bullish outlook maintained by mainstream media and much of the general public.

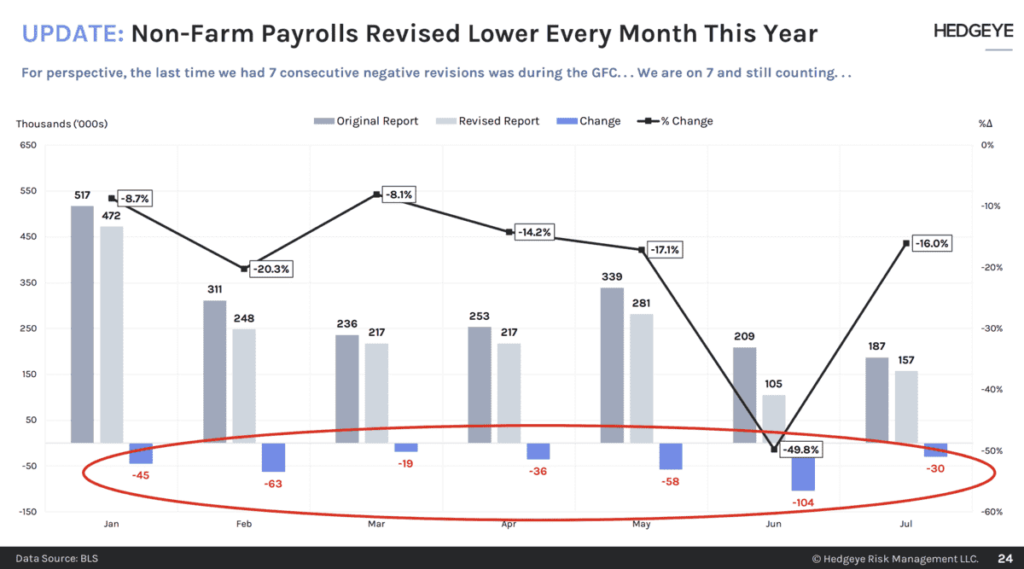

The Bureau of Labor Statistics reports Non-Farm payroll statistics each month. The reports so far have been pretty rosy. These reports keep investors hopeful of a good economy going forward. However, the numbers have been revised lower seven months in a row. The last time that happened was during the Great Financial Crisis of 2008 when the S&P 500 lost 57% of its value. When you go back to prior times these revision trends have been consistently negative when economic downturns have occurred.

From April 2022 to March 2023, total non-farm employment was negatively revised down by 306,000 jobs. Total private employment was negative 358,000 jobs.

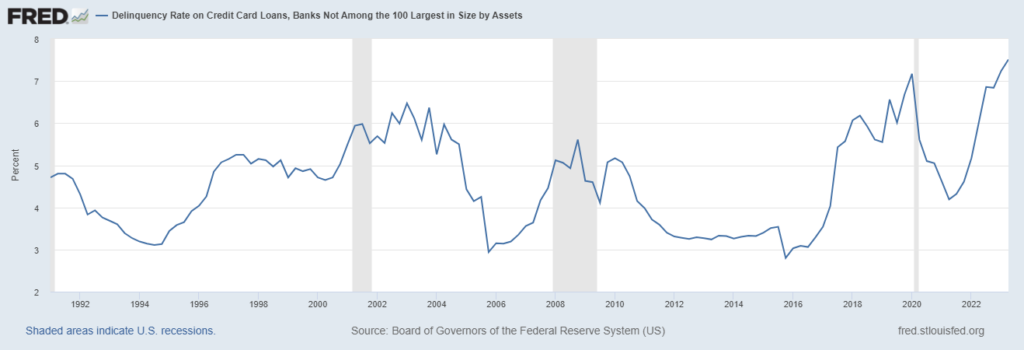

One concern that is popping its ugly head up is the health of the Regional Banks. The default rate on Credit Card loans just hit 7.51%. The last high was 7.17% during the Pandemic and now is much higher than the Great Financial Crisis and the Tech Bubble. We all know what happened to the stock market during those times. Also 70% of all commercial real estate loans are financed through Regional Banks and we know that commercial real estate is in trouble.

An under publicized fact is that inflation has started to rise again. Commodity prices are rising and that cost bleeds into the economy and thus into the cost of living. Just fill up your car with gasoline and you will see what I mean. If that trend continues, the Fed will be forced to possibly raise interest rates again or at the very least keep rates high longer. Their goal is to bring inflation down to 2%, so believe that they will not stop putting their foot on the brakes until they bring inflation down to their goal or that something fails in the economic system. The Regional Banks are what could possibly be the that trigger.