QUOTE OF THE WEEK

“There is no passion to be found playing small- in settling for a life that is less than the one you are capable of living.: – Nelson Mandela

TECH CORNER

The confirmation is in. All four of the major stock market indexes (Dow, S&P 500, Nasdaq, and Russell 2000 small cap) have turned to a negative trend. The last to turn was the Nasdaq which happened last week with the Russell 2000 being by far the weakest. The stock market performance last week confirmed the trend as the “Magnificent Seven Stocks”, which have been holding up the markets, were down an average of 5.3%. As of today, Wednesday, the stock markets are still declining. If you own stocks individually or in a mutual fund, I don’t see how this doesn’t end badly.

I want to address the health of the U.S. consumer. This issue is something that I have discussed in the past so hear me out even though it sounds like I am being redundant.

Last week we got the number on the monthly retail sales for September and it came in at very healthy +0.7%. Add on to that a +0.8% for August and it looks like there is no top for the consumer spending their money. Remember that consumers are approximately 70% of U.S. GDP (Gross Domestic Product), however, just like a hurricane approaching, the storm clouds are just over the horizon and coming this way.

For example:

*Gasoline prices are high. Many people need their car and so they have to drive.

*Student loan borrowers are starting to have to make their payments on their loans.

*The excess savings that people accumulated from the stimulus payments during Covid 19 have declined from $2.1 trillion down to $200 billion.

*The savings rate for the consumer has dropped from 32% during the pandemic now down to 3.9% which is much lower than before the pandemic.

*Credit card interest rates are now at an average of 21% vs 16% during the Tech Bubble and 14% during the Great Financial Crisis.

*Defaults on Credit cards, auto loans, and mortgages are at an all-time high and are going vertical.

*Even though the employment market is tight we are starting to see new hiring backing off as reported by Employment Agencies.

*Fidelity, which manages 401k portfolios for millions of people through their employers, has reported that hardship withdrawals have hit an all-time high and are rising at an accelerated rate.

I could go on and on, but the consumer spending hurricane is coming soon. What can’t go on forever, won’t.

There has been a lot of talk recently about the residential real estate market. If you are looking for a home or you are trying to sell a home, I hope you find this article from “The Real Economy” interesting.

Existing home sales fall to the lowest level since 2010

OCT. 19, 2023 BY TUAN NGUYEN

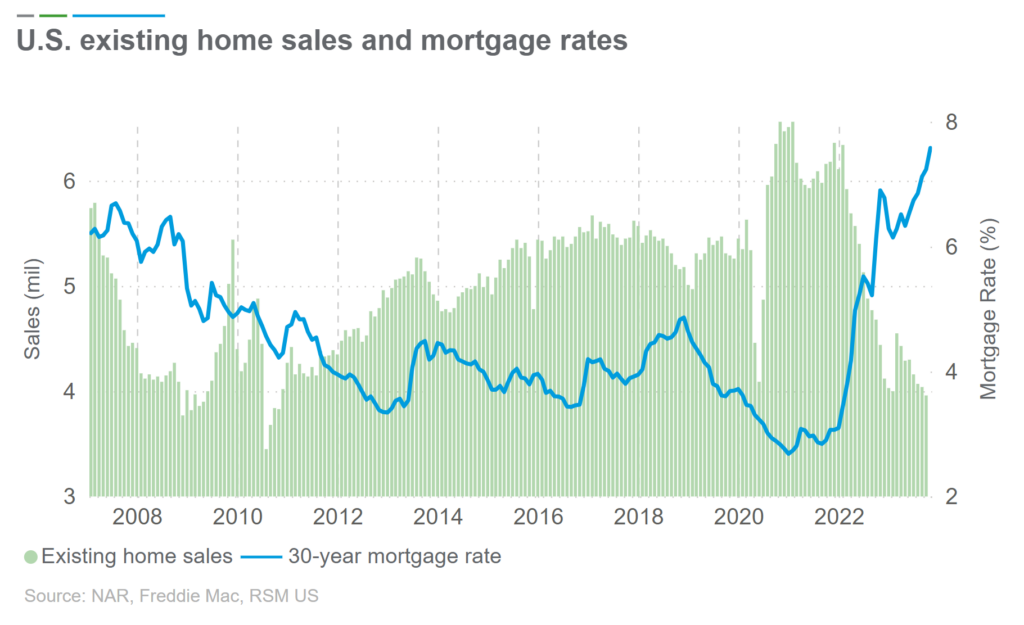

Existing home sales fell in September to the lowest level since 2010 as mortgage rates hit a multidecade high.

Even if the Federal Reserve holds interest rates steady in the next two months, the lagged impact of monetary tightening, especially quantitative tightening, has continued to put pressure on long-term yields.

The bonds selloff in the third quarter with the 10-year Treasury yield marching toward 5%–the highest since 2007—has brought mortgage rates, which correlate with long-term yields, to close to 8%.

As a result, demand for existing homes has plunged in six out of seven months since February, falling to 3.96 million in September, according to data released Thursday by the National Association of Realtors. That was equivalent to a 13% drop in seven months.

The decline has occurred even as the market remains millions of homes short in meeting the underlying demand. But with prices and mortgage rates at multidecade highs, many Americans looking for a home simply cannot afford one.

That is particularly true for single-family homes, which drove most of the decline in existing home sales and are a lot more expensive. Condominium and co-op sales, while also dropping in September, remained above the low of 2020.

Because of elevated borrowing costs, there were more all-cash buyers last month than the previous five months, reaching 29%. A year ago, the figure was 22%.

Looking ahead, even if the short-term interest rates stay at the same level, the Federal Reserve will not stop its quantitative tightening, or reducing its balance sheet, anytime soon. That should keep the long-term interest rates high for quite some time, dampening demand for existing homes.

Buyers, as a result, have been looking for opportunities from the new home market, where supply has been more solid. That said, we should not expect any material improvement from housing sales until mortgage rates stabilize.

Buyers are most likely pulling back, waiting to spend when rate cuts begin, which won’t be until the middle of next year at the earliest.