QUOTE OF THE WEEK

“Obstacles are what you see when you take your eyes off your goal.” – Unknown

TECH CORNER

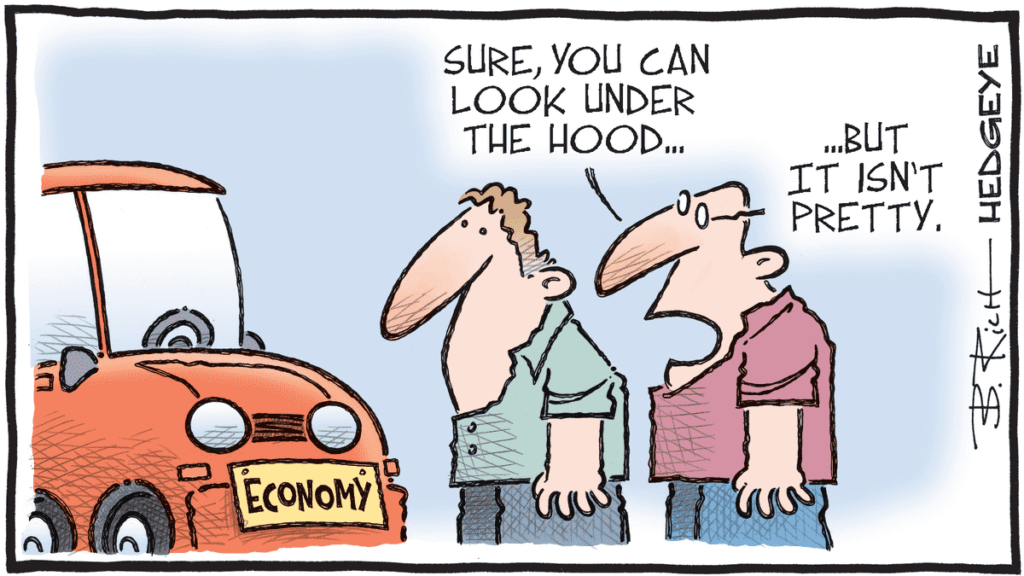

I realize that we have been predicting the coming recession for most of last year. We are still predicting a recession for this year. The data is getting worse and many of the indicators that we track have had a 100% track record of preceding coming recessions.

For example, the inverted yield curve which I have discussed in a previous letter has a 100% record of predicting recessions.

Here is another data release from The Empire State Manufacturing Survey that had its worst two-month contraction ever. “The Headline print and New Orders both fell to lows matched only by the trough of the pandemic. A month after falling 24 points, the General Business Conditions Index plummeted another 29 points in January, a nadir last seen in May 2020. It takes the series down well below the lowest point it ever got to during the Great Financial Crisis of 2008-2009.” Not good, actually terrible.

The market that could send the banking system into big trouble is the Commercial Real Estate market. The National Bureau of Economic Research just reported that 14% of the $2.7 trillion real estate loan market is under water. What that means is, those loans from banks, primarily regional banks, have loans on their books where the real estate values are below the balances of loans. For office properties, 44% of the loans have balances higher than the value of the offices. Just in the last few months, three high-rise office buildings in downtown Los Angeles went into default and the owners just turned the keys over to the banks. Add to that, many buildings are coming up for renewal on their mortgages which will have to be refinanced at much higher interest rates than they got during the pandemic.

Obviously, no one can predict the future but the data is going in the wrong direction fast.

We are still currently positioned in intermediate duration high quality bond funds in the Variable Annuities. We are positioned in a high interest rate U.S. Government Money Market and 1-3 year U.S. Treasuries in the managed accounts.

The plan going forward is to stay conservative until interest rates start to drop and then extend the duration in U.S. Treasury bonds in the managed accounts. Remember, when interest rates drop, bond values go up. Interest almost always drops during recessions.