Talking about the Yield Curve

QUOTE OF THE WEEK

“Creativity is a habit and the best creativity is the result of good work habits.”

Twyla Tharp

TECH CORNER

Over the last 31 days the S&P 500 has rallied up +9.9%. Some are questioning why we didn’t participate in that rally. However, take into consideration that the S&P 500 from July 31st to October 27th (the bottom) was down -10.3% for a net loss of 1/2 of one percent. I think it is important that you understand that the assets we manage for you are what I call “serious money”. We have a duty to help protect your assets so that you can accomplish your retirement goals or any other financial goals that you may have.

We manage you assets using data. In the long run using data rather than chasing short term rallies will always outperform. Chasing the recent rally could have turned out to be chasing fool’s gold and the markets could have continued down from July 31. The system is designed to never invest your money against the data. The data we are now seeing and have been seeing is a coming recession. For example one indicators of coming recessions is the “inverted yield curve”.

This explanation of the “inverted yield curve” is a repeat of the Tech Corner from August 14, 2023. As stated above we are not going to take chances with your “serious money” and that is why the systems we use are not going to invest against the data.

:

The following is from the YMOT dated 8/14/2023

Let’s talk about the Yield Curve today and how it affects the economy.

First what is the Yield Curve? There are multiple Yield Curve examples but today we will talk about the most common, the yield of the 10yr US Treasury vs the yield of the 2yr US Treasury.

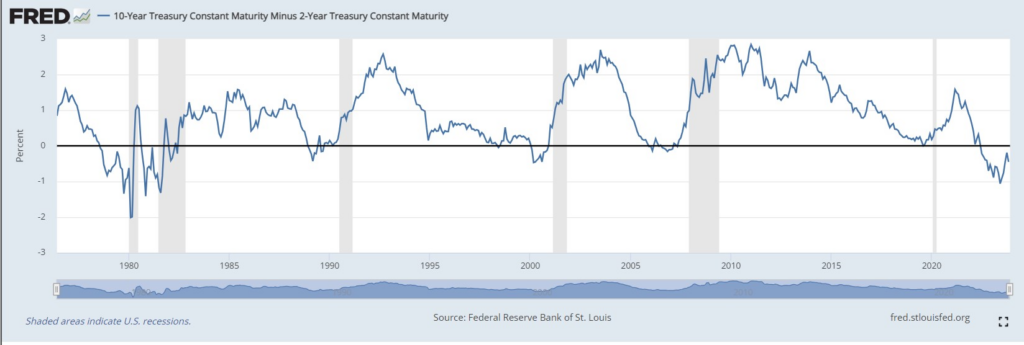

The math of the Yield Curve goes as follows: Take the yield of the 10yr and subtract the yield of the 2yr. The current 10yr yield is 4.21% and the yield of the 2yr is 4.95%. This computes to a negative yield of -0.74% thus an inverted yield curve.

Now assume you are a bank and you are deciding whether to make a loan using only the interest rate example of the Treasury yields. Under normal conditions we have a positive Yield Curve meaning you take in deposits at say a normal 1% and you loan them out at 4%. Your profit is the difference of 3%. By the way, most long-term loans including mortgages, are tied to the 10yr rate.

Now what we have is a situation where the Fed is raising the Federal Funds rate to control inflation. That rate controls the short end of the interest rate curve (2yr rate). So, in the example above with short term interest rates at 4.95%, you would have to pay sophisticated investors at that rate to attract deposits. Loaning that money out at the long term rate of 4.21%, it would be unprofitable to make the loan.

In the old days most depositors were happy to get the low interest rate on their deposits. Now, sophisticated depositors aren’t satisfied being paid a low interest rate and are moving their deposits out of the bank and into short term rates via a Government Money Market Fund or buying 2yr Treasuries.

Keep in mind that loans are the oil of the economy. So, in this case, you as the bank are seeing your depositors taking their money out to get a higher rate. What this means for the economy is that, again, you as the bank, are not going to make an unprofitable loan nor do you have the money in deposits to loan because your depositors are fleeing to get higher interest rates. The effect is that loan volume dries up and if loans aren’t being made, the economy slows down.

The graph below shows what happens when we get an inverted Yield Curve as we have now, a recession (shown in grey) follows. This current yield curve is the most inverted going back to 1985. Historically, a recession followed a period of an inverted yield curve every time since 1976. The prediction of the political pundits and the news media is that we won’t have a recession or we will have a soft landing which may be highly improbable. Although I can’t say that won’t happen, we believe in data which is why we are positioned in bonds.

The yield curve is just one of the indicators in the data that we use. All the other indictors at this time point not to a “soft landing” that you hear on CNBC or Fox Business, but rather to a recession that could be a deep one. In every recession the stock market has suffered serious losses and we feel that now the risk is much too high to invest in the stock market. When the recovery from the recession begins, that will be the time to invest in the stock market. For now, we are playing it safe.

SOURCE; F.R.E.D