QUOTE OF THE WEEK

“Life shrinks or expands in proportion to one’s courage.” – Anais Nin

TECH CORNER

Today I want to talk about the U.S. consumer. The general assumption is that the consumer is in good shape but the truth is that the consumer, on a national basis, is now spending 5% more than their income. There is an old saying that goes “What can’t go on forever, won’t.” 50% of American households are living paycheck to paycheck. Credit card balances are up 17% year over year and to compound the problem, credit card interest rates have risen 5% over the last year.

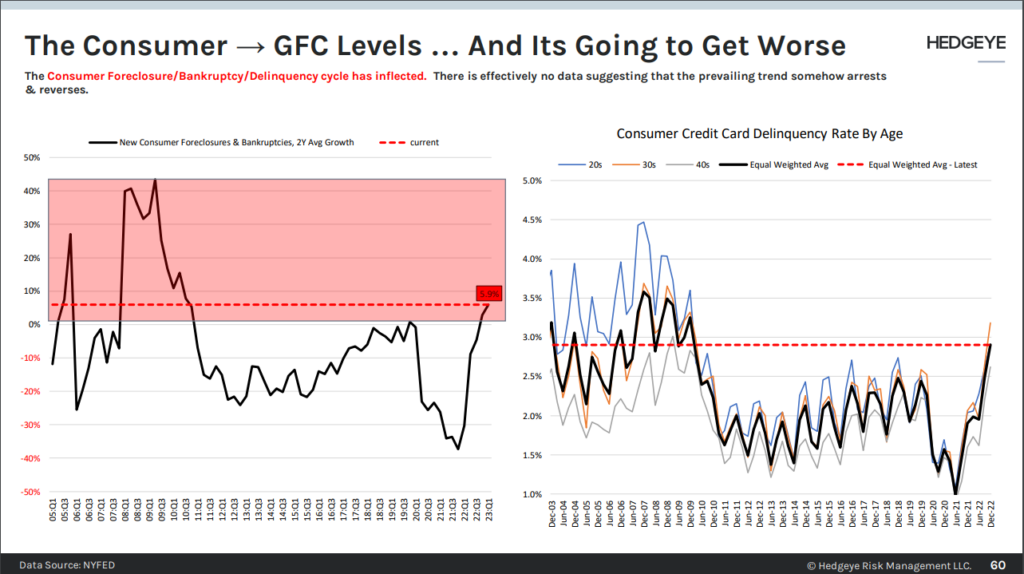

Now let’s take a look at some statistics. The graph below shows that the consumer is now starting to default on consumer credit cards. In other words, they are tapped out. Also, the number of foreclosures and bankruptcies are rising. The important take away for the graph is the rate of change of delinquencies, foreclosures, and bankruptcies. They are rising at a very steep rate and to change direction would require a drastic change.

It is important to remember that the consumer is 70% of the U.S. economy. The consumer is definitely slowing their spending. U.S. Redbook Weekly Chain Store Sales printed another negative number at -0.4% Y/Y, which was slowing versus the prior week. The retail data series started the year at +10% Y/Y and has slowed consistently as the year has progressed.

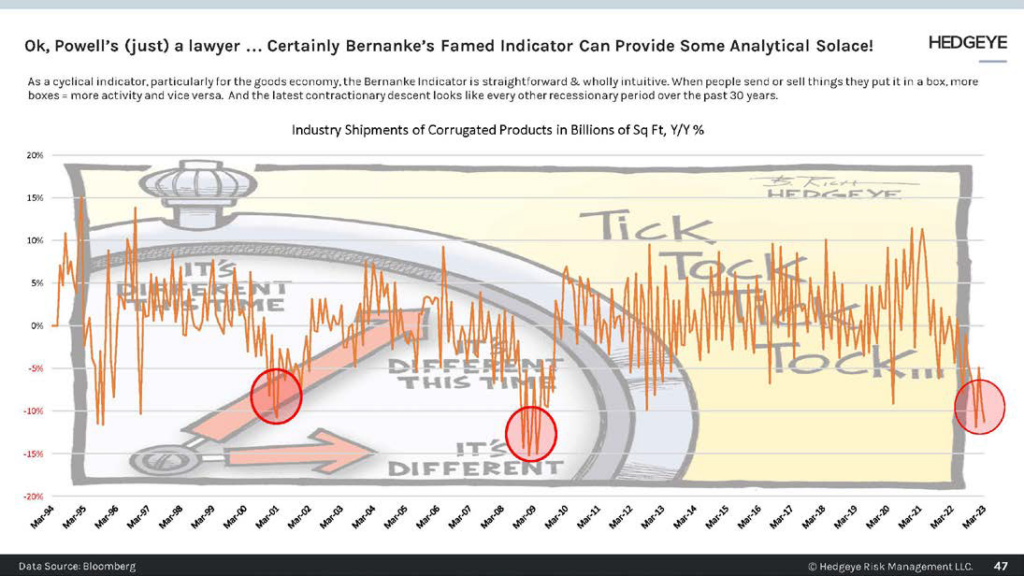

Another determining factor to the health of the economy is to look at freight shipping. David Jackson, the CEO of Knight Swift Transportation, which is the largest full truckload carrier, said the following on a conference call: “I don’t know that we’ve ever seen freight demand fall this far so fast and for so long without an accompanying recession”

Another indicator that the consumer is pulling back is Industry Shipment of Corrugated Products. Corrugated Products means cardboard. As you can see on the graph below when the use of cardboard for shipments falls below -10% we have had a recession.

The equity markets have had a substantial rally so far this year. What is perplexing is that the rally has happened when all the data is pointing down. Now is not the time to get greedy and jump into the equity markets. The downside risk is infinitely greater than the upside rewards.