Tech Corner

I sure am glad 2020 is over. Let’s hope that 2021 is better. As we head into 2021, I came upon a quote that I plan to exercise daily this year, and I hope you will too. “Always find time for the things that make you feel happy to be alive.”

Last year from an investment standpoint, was “bizarre,” to say the least. The year started off with a small rally. Then COVID hit and the markets crashed, with the S&P 500 down 37%. With the Fed’s help shoveling money into the financial markets, there was a historic rally. The markets finished higher for the year with the tech heavy Nasdaq driven by a small number of “stay at home stocks” really taking off. Tesla gained over 700% last year, which is ludicrous. From a market valuation standpoint, Tesla is more valuable than the combination of the next nine largest car companies in the world.

Due to the COVID issues, we have managed your portfolios with caution foremost in mind. We did not suffer the market crash in March and April, nor did we participate in the Fed-fueled rally. We met our goals of a positive return matching the assumed rate of return in the retirement analysis we do for our clients.

As a new year is beginning, I thought it would be a good time to review how we manage your money. We are entirely data and mathematics driven. We don’t rely on our hunches, gut feelings, or some pundit’s tips on CNBC or Fox Business. Our process is tightly structured.

For our managed accounts with Cambridge, we have divided the portfolio into two sections. The first section is invested in Exchange Traded Funds or otherwise known as ETFs. We use ETFs because of their low-cost structures. Based on the data, we will purchase ETFs that have a high mathematical probability of success. We start off with a 5% position of the portfolio. With our data source (Hedgeye), we receive risk ranges. If the ETF is at the bottom of the risk range, we will add 5% to the position. If the position reaches the top end of the risk range, we will sell half of the position. If the position is greater than the top end of the risk range, we will continue to hold the portion of the position we haven’t sold. The risk ranges will change daily due to a combination of volatility, volume, and price.

The second section of the portfolio is invested in individual stocks. Again, the stock selections are also based on data and mathematics. We will invest 2% of the portfolio in each individual stock. We receive from Hedgeye, our data source, the list of the stocks. If they add a new stock to the list, we will add it to the portfolio at 2%. If a stock falls off the recommended list, we will sell it, no questions asked. Again, process, process, process.

We also have many clients with Variable Annuities and Variable Life Insurance contracts. We use the same data-driven process with a twist. Rather than using ETFs and stocks, we use recommended sectors via the contracts’ sub-accounts to make our selections for asset allocations. If the sector has a high probability of success, we will own it. If that sector no longer has a high probability of success, we will sell it.

This Thursday, we will have our quarterly conference call with Hedgeye. Next week we will give you a detailed report from the call as to what they see as the future for both the near term and long-term analysis of the markets. Stay tuned next week.

Larry’s Thoughts

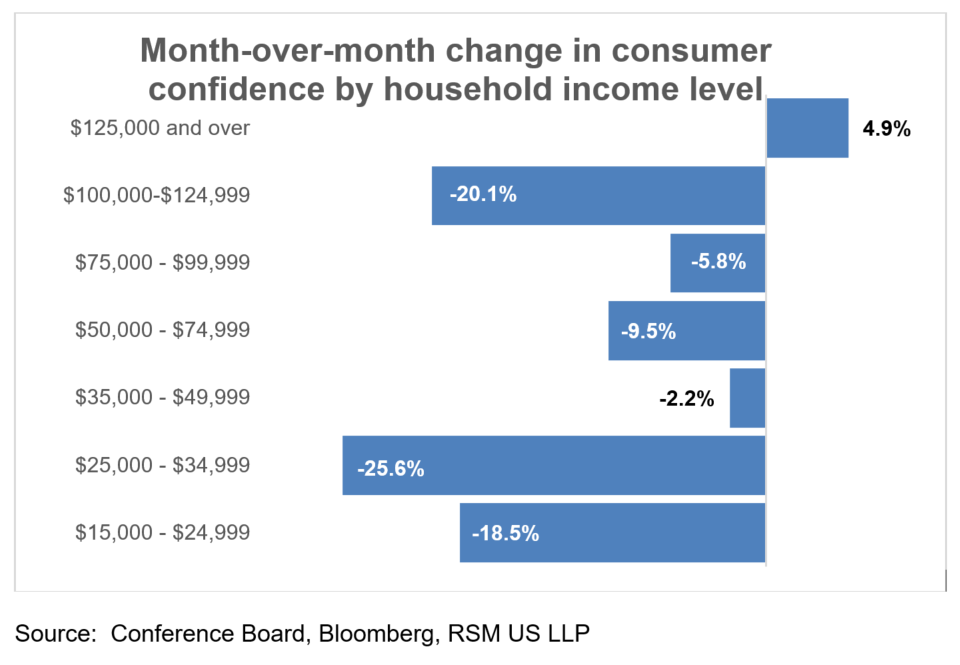

I thought you might find this chart interesting. Not everyone has a positive outlook for the future. If the vaccine wins over the virus, hopefully attitudes will change.

https://us20.campaign-archive.com/?e=141e4efb91&u=e8b2fdd83674b2c256569ff80&id=364285dfe8

CHART OF THE DAY: $900 billion rescue package will aid consumers who need it most

DEC. 22, 2020 BY PETER CADIGAN

The December decrease in U.S. consumer confidence shows how important fiscal aid for households provided by Congress’s new $2.3 trillion spending bill is to consumers. The Conference Board Consumer Confidence Index, which is based on a survey of a random sample of U.S. households, fell short of expectations, down 7.8% to 88.6 from a revised 92.9 a month earlier, its lowest reading since August. The fall in confidence was largely concentrated on households with annual incomes under $125,000.

The December measurement is consistent with a muted holiday shopping season amid a resurgent spread of the coronavirus and short-term economic uncertainty. It also shows that the narrative of pent-up demand may be limited to those upper income households whose incomes are more closely tied to jobs in sectors of the economy less impacted by the virus.

The stimulus package provides aid to those households where confidence is on the decline in the form of direct payments of $600 to individuals who earn up to $75,000 per year or $1,200 to families making up to $150,000 per year. These direct payments, coupled with extended unemployment benefits, small business relief plans, and public health and education measures, will help extend a financial bridge for these households until a stronger recovery and as vaccines become more widely distributed.