QUOTE OF THE WEEK

“I have noticed that even people who claim everything is predetermined and that we can do nothing to change it, look before they cross the road.” – Stephen Hawking

TECH CORNER

I hope everyone had a great Holiday Season.

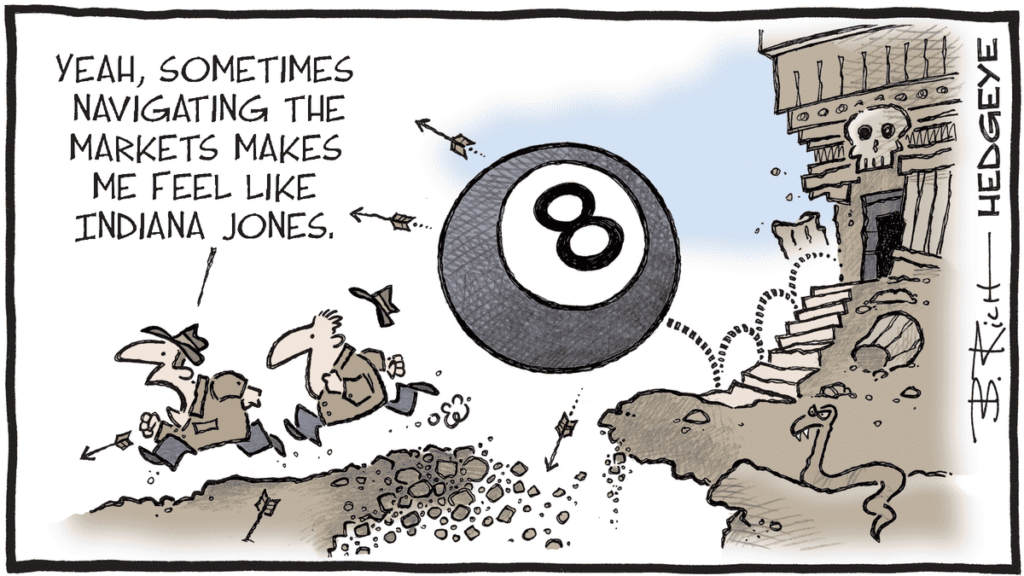

Unfortunately, we missed the Santa Claus stock market rally during November and December.

I think it is important for you to understand our philosophy on managing your assets that you have trusted us with. First, we are not short-term traders. We manage your assets using Macro or long-term trend analysis. We believe, and it is proven, that managing assets for the long term is a better process than trying to time the short-term ups and downs in the markets.

We also believe that following the trends in the data has the best probability of success in the long run. We also believe that our job is to be prudent in the investment decisions we make for you and to certainly not take imprudent risks investing contrary to the data as it always wins in the long run.

The Santa Claus rally had a foundation of sand rather than hard ground. It is important to understand that stock values go up when earnings go up. S&P 500 earnings have flat lined so the appreciation during the November and December rally is based more on the hope of the Fed lowering interest rates. The Fed has promulgated in their recent statements that they will probably not be raising interest rates going forward and will possibly be lowering rates slowly sometime in 2024 based upon their future data.

There are two indicators that will confirm a recession. First, is rising unemployment which has already started but we will know a lot more this Friday when the employment numbers come out.

The second indicator is the widening of credit spreads. I have discussed this in a prior letter but let me explain again. Credit spreads are the difference between the return of the risk-free yield of Treasury bills and the cost of borrowing by businesses either from issuing bonds or borrowing from the bank. As the interest cost of issuing bonds or borrowing from the bank goes up, that cost goes directly to the bottom line lowering the profits. This in turn lowers the value of the business, thus, lowering the stock price if it is a publicly traded company.

I understand that it is frustrating to have missed the rally, however, we would rather save you from potential losses by going against the data and taking imprudent risks trying to time the market. There will be a time when the data turns positive and that is when we will take advantage. Until then, we plan to stay with a conservative asset allocation.