The Big Debate…

Deep recession, soft landing or none at all.

We Are Getting Closer

There are many indicators that point to a recession.

Common Scams To Watch For

Don’t be the victim of a scam

QUOTE OF THE WEEK “When you practice gratefulness, there is a sense of respect toward others.” – Dalai Lama TECH CORNER Not much to report this week. So far this month the bond market is down about 3%, the S&P 500 is down 4% and the Nasdaq is down 6%. The stock market failed to break through its resistance level and is heading down. The bond market was hurt by Fitch, the rating agency, downgrading the U.S. credit rating from AAA to AA+.The data is still showing and we are still expecting a recession which is historically good for bonds and bad for the stock market. The recession is still not here yet and could arrive as late as the end of 2023. The trend of the data for the economy is definitely not positive.

What Is The Yield Curve?

QUOTE OF THE WEEK “When you practice gratefulness, there is a sense of respect toward others” – Dalai Lama TECH CORNER Let’s talk about the Yield Curve today and how it affects the economy. First what is the Yield Curve? There are multiple Yield Curve examples but today we will talk about the most common, the yield of the 10yr US Treasury vs the yield of the 2yr US Treasury. The math of the Yield Curve goes as follows: Take the yield of the 10yr and subtract the yield of the 2yr. The current 10yr yield is 4.21% and the yield of the 2yr is 4.95%. This computes to a negative yield of -0.74% thus an inverted yield curve. Now assume you are a bank and you are deciding whether to make a loan using only the interest rate example of the Treasury yields. Under normal conditions we have a positive Yield Curve meaning you take in deposits at say a normal 1% and you loan them out at 4%. Your profit is the difference of 3%. By the way, most long-term loans including mortgages, are tied to the 10yr rate. Now what we have is a situation where the Fed is raising the Federal Funds rate to control inflation. That rate controls the short end of the interest rate curve (2yr rate). So, in the example above with short term interest rates at 4.95%, you would have to pay sophisticated investors at that rate to attract deposits. Loaning that money out at the long term rate of 4.21%, it would be unprofitable to make the loan. In the old days most depositors were happy to get the low interest rate on their deposits. Now, sophisticated depositors aren’t satisfied being paid a low interest rate and are moving their deposits out of the bank and into short term rates via a Government Money Market Fund or buying 2yr Treasuries. Keep in mind that loans are the oil of the economy. So, in this case, you as the bank are seeing your depositors taking their money out to get a higher rate. What this means for the economy is that, again, you as the bank, are not going to make an unprofitable loan nor do you have the money in deposits to loan because your depositors are fleeing to get higher interest rates. The effect is that loan volume dries up and if loans aren’t being made, the economy slows down. The graph below shows what happens when we get an inverted Yield Curve as we have now, a recession (shown in grey) follows. This current yield curve is the most inverted going back to 1985. The probability of a recession following a period of an inverted yield curve has been 100%. The prediction of the political pundits and the news media is that we won’t have a recession or we will have a soft landing which may be highly improbable. Although I can’t say that won’t happen, we believe in data which is why we are positioned in bonds.

U.S Credit Card Debt

QUOTE OF THE WEEK “Gratitude makes sense of our past, brings peace for today, and creates a vision for tomorrow.” Melody Beattie TECH CORNER Not much to report. I did hear this morning that the US credit card debt officially just passed $1trillion. Combine that with the fact interest rates on credit card balances have gone up 5% over the last twelve months. That will eventually put a crimp on consumer spending. Gen Z is the fastest growing generation in piling on the debt. We are still positioned in US Treasuries of multiple durations in the managed accounts and we are positioned in intermediate duration high quality bonds in the annuities. Should a recession come as we anticipate, that the allocation will not change unless we get a signal that the recovery from the recession has started.

QUOTE OF THE WEEK “It does not matter how slow you go as long a you do not stop.” – Confucius TECH CORNER Last month we had a slight increase in interest rates resulting in a small decline in bond values. We currently own Treasuries and investment grade bonds at high interest rates. I expect we will be maintaining these positions for quite a while. These high interest rates should come down as we head into the recession which is good for us. Remember bond prices go up as interest rates come down. We are still convinced that we are headed into a recession. It just isn’t here yet. The stock market is of course not the economy, particularly when the Magnificent Seven “artificial intelligence” related stocks are up 49% while the other 493 stocks of the S&P 500 are only up around 2%. This same set of circumstances occurred in the Teck Bubble of 2000 to 2002 where any stock that in anyway was tied to the “new” internet roared up in value and the stock market eventually declined by 50% from the top to the bottom. My favorite saying back then was if the company’s name was “No Revenue No Earnings.com” it would rise in value. This rise in the Magnificent Seven has not been driven by profit increases but rather by having Artificial Intelligence associated with the company. Those companies are up a lot. This rally is not broad, it is very narrow. So far this year as to the stock market, it seems as though economic data doesn’t matter. But eventually gravity will win. Here are a few of the latest data points for the economy: China and European PMIs both slouched into deepening contraction. PMI stands for Purchasing Manager’s Index and are surveyed as to how much the companies are purchasing. This index is an excellent picture of the economy and if companies are not purchasing goods, that means the companies are expecting hard times ahead. South Korean export growth made a new rate of change cycle low of -16.5% year over year in July. Remember the US is part of the global economy. The Dallas Fed showed new orders declining to a fresh YTD low of -18.1%. The Fed Senior Loan office survey of banks showed further tightening in lending and an accelerating contraction in demand for loans. The Treasury increased its debt issuance target for the second half of this year to $1.85 trillion. Yes that’s right, this is just for the back half of this year with an annualized interest expense already at $1 trillion. And yes, that number reflects weaker-than-expected tax receipts and will get meaningfully worse if we fall into an outright contraction and tax receipts tank further. And yes, we don’t have the “cash” to pay that debt or the interest on it, so we will issue more debt just to pay the interest expense. Going forward the data looks pretty gloomy for the economy. We shall see how it plays out. Due the fact we own high interest rate bonds I think we are in a good position to weather any storms that maybe coming. Safe is the operative plan going forward.

The U.S. Consumer

Let’s tak a look at some statistics

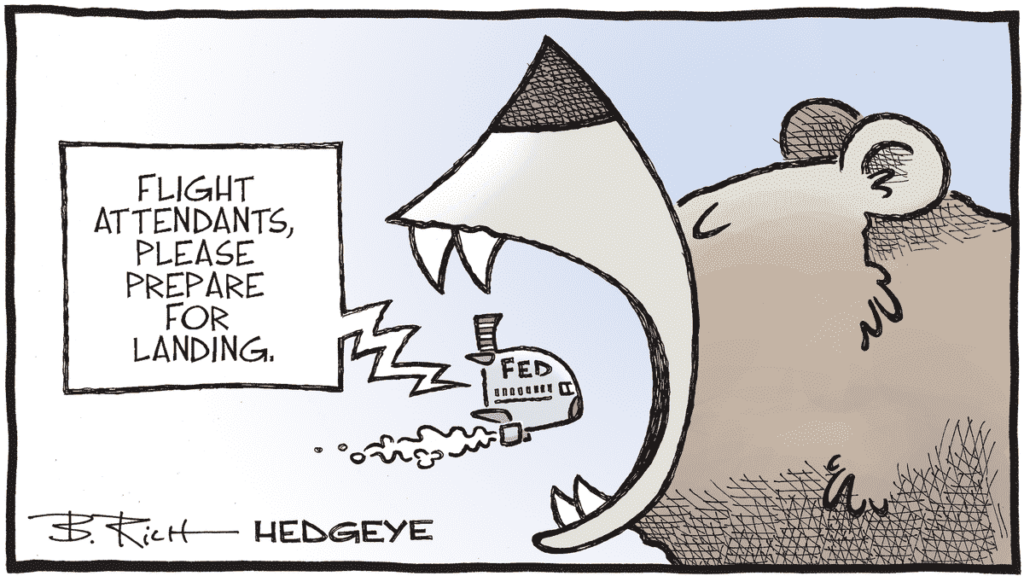

Is a recession on the way?

QUOTE OF THE WEEK “With confidence, you have won before you have started” – Marcus Garvey TECH CORNER This week I am going to paraphrase from Stanley Druckenmiller, a famous asset manager, who has never had a losing year whom I happen to agree with. We both agree that a recession is on the way due to a year of aggressive interest rate hikes from the Federal Reserve trying to fight sticky inflation and that a hard landing is inevitable. There are more shoes to drop. This is really the Fed’s fault for blowing up an asset bubble in stocks, real estate, and other sectors by keeping interest rates low for so long after the Global Financial Crisis with their easy money policies. The Fed switched their policy in 2022 and started raising rates and we know that led to the dismal stock market returns for that year. High interest could lead to more issues in key sectors of the economy like what happened with the regional banks in March when Silicon Valley Bank rapidly failed forcing regulators to step in and backstop depositors. We now have an ailing commercial real estate market especially in the office sector as many employees are now working from home. Many of the commercial real estate assets are financed by regional banks which will put added pressure on them as owners start to miss mortgage payments. As I have stated before and I will go into detail next week, the banks capital is drying which has resulted in them just not loaning money. They are taking fewer risks amid slowing economic growth which is leading to a “credit crunch.” There is a lot of stuff under the hood in this type of environment due to the biggest and broadest asset bubble ever. When you add in a 5% interest rate increase in one year, the bankruptcies we have seen in the banks and other big firms such as Bed Bath & Beyond, it is most likely just the tip of the iceberg. The probability that a recession will come in the second half of this year is in the cards and it could be deeper than the so called mild recession or a “soft landing. The stock market always declines during recessions. The recent run up in the markets so far this year can’t be justified with earnings declining.. Earnings are expected to go negative for the second quarter of 2023. The warnings are dire and the economy is teetering on the brink of a hard landing and should it crash, it is likely that bankruptcies will surge, unemployment will jump over 5% and corporate profits will drop at least 20%.

Stock market rally this year

QUOTE OF THE WEEK“The secret of success in life is for a man to be ready for his opportunity when it comes.” -Benjamin Disraeli TECH CORNER This week will be a short letter. I am recovering from a shoulder replacement surgery of a previous replacement that went bad which is why I didn’t publish the letter last week. I am probably sure that you are wondering why we haven’t participated in the stock market rally this year. Don’t be fooled by this rally. It is a “false flag” rally. Only seven stocks are responsible for the returns so far this year. If you look at the other 493 stocks in the S&P 500, collectively they are down for the year. Earnings are declining and that should be evident when earnings reports for the 2nd quarter start coming out soon. Next week I will go into more detail as to why the stock market is headed for a fall. We are still positioned in US Treasuries.

The Fed Has Paused Raising Interest Rates

QUOTE OF THE WEEK “The secret of contentment is knowing how to enjoy what you have and to be able to lose all desire for things beyond your reach.” – Lin Yutang TECH CORNER As we expected the Fed has decided to pause raising interest rates. Chairman Powell said that they were going to follow the data, however he put the possibility of raising rates another 1/2 of a percent in the future. No guarantee, but I think they are done raising rates because the economy is continuing to slow. As stated before, when the Fed stops raising rates, long term interest rates will start to decline. As stated in the last letter we have allocated the managed portfolios in U.S. Treasuries over multiple durations from 1-3 year up to 30 year bonds. Last week the markets were up substantially with what I would call a “relief rally” due to the Fed pausing on their rate increases. Even with this rally, under normal conditions, stock prices will rise when earnings go up. Last quarter the S&P 500 earnings were flat. We don’t yet know what earnings will be for the second quarter, but the projections are that they will be negative so this may not be a sustainable rally. Everyone is excited by the year to date increase in the S&P 500 of 15.19%. Many are assuming that the bear market is over but no one is talking about the underlying statistic that is driving the performance of the S&P 500 this year. The performance of the “magnificent seven” stocks in the S&P 500 are up 78% year to date. In other words, the performance is being driven by only seven stocks. If you go back to the beginning of 2022, five of the seven are down, with some substantially down. One stock is up slightly, and one is up over 20%. Don’t be complacent as there are strong headwinds to the economy and the stock market going forward. The Purchasing Managers Index (PMI), the index that measures month over month economic activity in the manufacturing sector, is at 42. Anything below 50 is a contraction in manufacturing and every time the index has fallen below 46, a recession has followed. Due to the Debt Ceiling Debate the Fed has had to drain the Treasury General Account. This is the checking account of the Treasury. It was depleted down to approximately $50 billion to finance the government during the period when we were waiting for the resolution on the Debt Ceiling debate. The normal balance is around $1 trillion so this means they are selling Treasury bonds to get the account back up to the $1 trillion balance which will be taken out of the economy from people buying those bonds. One of the issues that will probably affect the economy going forward, is the fact that credit card balances have risen 17% over the last 12 months. Consumer spending is 70% of the U.S. economy but people are paying for living expenses using their credit cards. Add to that the interest rates have risen 5% over the last year leaving the consumer stretched and running out of money. Another component of the pandemic era relief for households is coming to an end. The debt limit deal struck by the White House and congressional Republicans requires that the pause of student loan payments will end by August 30th so student debtors will have to start making their payments again. This will also slow consumer consumption. The recession is right around the corner but how deep and how long is yet to be determined and keep in mind that the stock market declines with every recession. We are currently positioned in U.S. Treasuries of different durations with managed accounts and intermediate term bonds in the annuities. Sources: NY Times,. Time Magazine 576701.1

Confirmation That The Economy Is Slowing

QUOTE OF THE WEEK “Hard times don’t create heroes. It is during the hard times when the ‘hero’ within us is revealed.”– Bob Riley TECH CORNER Last week the Debt Ceiling Extension passed with 63 yes votes and 36 no votes in the Senate and 314 yes votes and 117 no votes in the House. It should have passed unanimously in both houses due to the unbelievable damage it would cause if not passed. I understand that certain members of the House and Senate on both the left and right needed to cater to their respective bases with a no vote. The betting is that it looks like the Fed is going to pause raising interest rates when they meet on June 13 & 14. There are already signs that this may be the last raise in interest rates because unemployment is starting to rise. Jobless claims totaled 262,000 for the week ending June 3rd. The total was well ahead of Dow Jones estimate of 235,000 and was the highest weekly rate since Oct. 30, 2021. A total of 1,635 million people were receiving jobless benefits through May 20th, up from 1,283 million from a year ago. It is important to understand that rising unemployment is a “lagging indicator” as to the direction of the economy. It is more than anything a confirmation that the economy is slowing which is exactly what the Fed wants to see. If all this is true, the Fed should stop raising interest rates which is a signal that long term interest rates should start to decline which is exactly the signal to invest into the bond market. It is also important to understand that all the “leading indicators” have been in decline for months. The groundwork has been laid signaling a coming recession. It now appears that the recession could be pretty deep. So, if you are considering jumping into the stock market, the risk is high and the rewards are limited. Please remember that the big stock market crashes since 2000 have all happened during recessions. The data says we are in the “eminent recession” phase, but we are really close to entering the recession. All of the data we follow suggests now is the time to enter the U.S. Treasury bond market. Last we allocated the Cambridge accounts to U.S. Treasuries of multiple durations from 1-3 years up to 30 years to diversify the risk. Remember when interest rates fall, bond prices go up. All the annuity contracts are currently allocated to moderate duration quality bonds. Sources: Department of Labor 5734526.1

Debt Ceiling Debate

The really big issue is the coming debt ceiling debate. We are the only country on the planet that has this stupid issue.

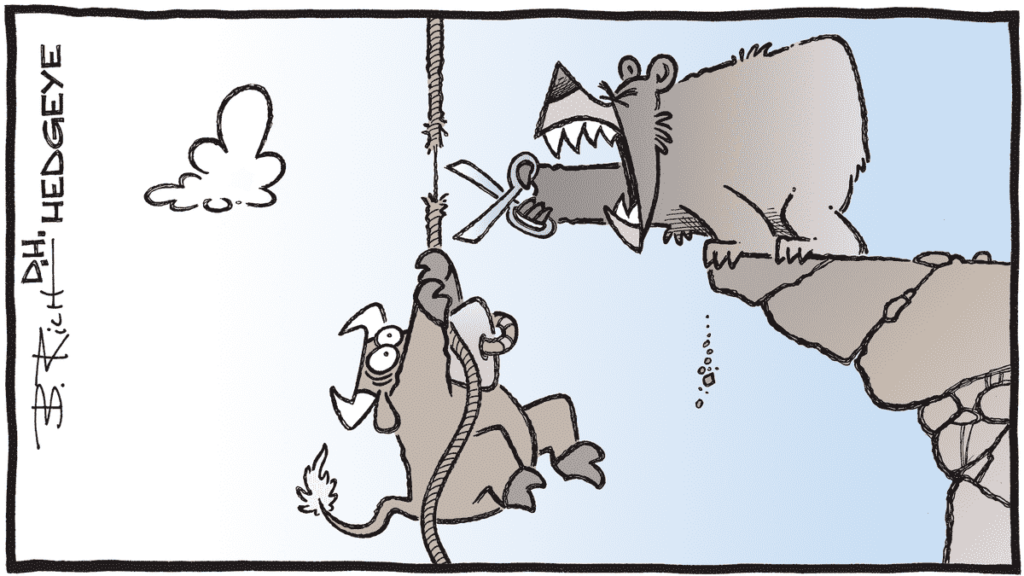

Oil in the engine

QUOTE OF THE WEEK “Our greatest glory is not in never falling, but in rising every time we fall.” – Confucius TECH CORNER The most recent update from Omega Squared, our investment advisory partner, is that we are not quite yet in a recession but we are getting close and looks like we will be there sometime in the next three months or so. Will it be a soft landing like the Fed is saying, or will it be a deep recession? It is tough to make an accurate predication but just like always we will let the data tell us. A couple of recent reports that don’t bode well for the future are NFIB Small Business Sentiment hit another new cycle low and U.S. Redbook Weekly Retail Sales remain in the doldrums at cycle lows for the second week in a row. What I really want to talk about is the most recent report of the Senior Loan Survey which is the survey of senior loan officers at the banks. This survey covers the period of March 22nd to April 7th, which is somewhat dated, and hasn’t taken into consideration the effects of what will come out of the debt ceiling crisis currently being debated in Washington. The survey is showing that commercial loan standards are tightening, loan demand is falling, and credit spreads are widening. This is the fourth consecutive quarter that commercial loans are falling and is now lower than the recessions of 1991 and 2001 but it isn’t worse than the Great Recession of 2008. Commercial real estate standards are significantly tightening and demand is notably weakening, especially for office space, as people who were working from home during the pandemic are not returning to the office. On the consumer side we are seeing credit tightening on credit cards, auto loans, and all other consumer loans. Every quarter the Fed asks a series of questions of the banks. Two of these being how and why banks are expected to change lending standards over the remainder of 2023. The answer was that over all loan categories, banks are expected to tighten credit over concerns of expected deterioration in credit quality of their loan portfolios and borrower’s ability to pay. The other concern in the survey to cause banks to draw back on lending, is that the banks are concerned about funding costs, their own liquidity, and deposit outflows. What does this all mean for the economy and the likelihood of a recession? It is important to remember that loans are the “oil in the engine” of the economy. Without loans businesses will have less capital to expand, potentially putting new initiatives on hold, or worst of all not be able to pay expenses or salaries. This slows the economy and then it turns into a vicious economic cycle downward. Sources: Hedgeye

Earnings season?

50% or so rally off the bottom. Don’t be fooled by this rally. The data is still negative.

Corporate Earnings Season is Starting

QUOTE OF THE WEEK “Kind words are the music of the world.” – F. W. Faber TECH CORNER Corporate Earnings Season is Starting First quarter earnings season has already started and will last through Memorial Day. Some banks have already reported showing big banks doing well and some small banks not so much. As far as the banks are concerned, the Fed has stepped in giving them access to a lending window should they get into trouble if depositors start to make a “run on the bank”. So as of now, it appears banks are safe. The big concern for the economy is that because of the failure of Silicon Valley Bank, which has led to transfers of deposits from smaller banks to larger banks, they are now reluctant to make loans that would deplete their capital. Even the big banks are cutting back on loans. For example, Bank of America, one of the two biggest banks along with J.P. Morgan, has cut back on loans. Bank of America loan volume has dropped over the last three quarters by 12%, 10% and 7% respectively. Without the access to loans, businesses are restricted in expanding and often are facing restrictions in day to day operations. We are now in the part of the economic cycle where GDP (Gross Domestic Product), inflation, and corporate profits are declining. The question is how will this part of the cycle affect the stock and bond markets? The easy answer is if inflation is declining the bond market will do well because interest rates should decline. This is what we are expecting to happen and when we start to see declining rates, we will move into the bond market. As part of this cycle and if corporate profits start to decline, the stock market will do poorly. Remember, stocks rise when profits are rising and stocks decline when profits are declining. All indications show that we are beginning a corporate profit’s recession. The combination of banks being less willing to lend and a slowing economy, we see hard times ahead for the stock market. Even though it is early in the corporate earnings season we are getting an indication of where we are headed. For example, using the Nasdaq 100 which is made up of the largest 100 companies in the Nasdaq Index, nine of the 100 companies have reported earnings. The composite earnings of those nine companies are down -38.3%. We won’t have the entire picture of this earnings season for a while but the trend of the data so far is recessionary. Sources: Yahoo Finance, Hedgeye, Arizona Daily Star, Bloomberg, NPR,

Five Questions about Long-Term Care

Grab some popcorn and the drink of your choice. Sit back and watch the first quarter data come in.

Turmoil in the banking sector

The failed banks bought those long duration Treasuries when interest rates were low.

Officials Considered Pausing Increases

Projection of interest rates

The Collapse of Silicon Valley Bank

The FDIC’s guarantee

Week of March 6, 2023

QUOTE OF THE WEEK “The soul would have no rainbow if the eyes had no tears.” – Native American Proverb TECH CORNER Federal Reserve Chairman Jerome Powell testified today before Congress and the equity markets didn’t like what he had to say….

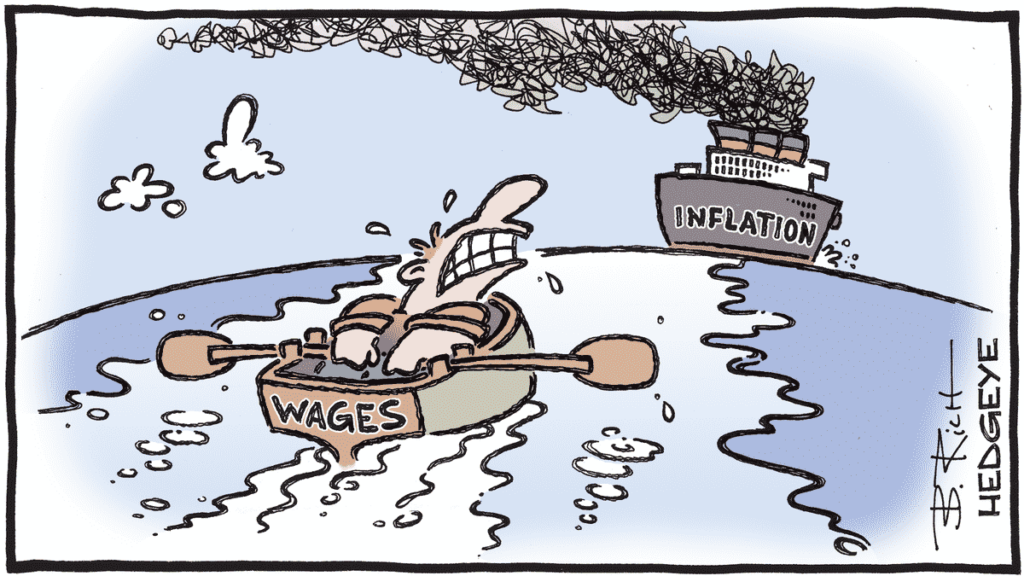

Equity Market, Economy and Housing Front

QUOTE OF THE WEEK “Hold fast to dreams, for if dreams die, life is a brokem winged bird that cannot fly.” TECH CORNER Last week was a bad week for the equity markets. The S&P 500 was down -2.66%, the Dow was down -2.97% and the Nasdaq was down -3.31%. As of Wednesday morning of this week, the equity markets are pretty much flat. It is appearing that they are giving up most of their gains for 2023. The S&P 500 has been down for the third straight week. Just a reminder, we do not hold any positions in the equity markets except for a small allocation to Private Equity. Just in the last few days a relatively small company, American Car Centers, declared bankruptcy. They have 40 dealerships around the country and they specialize in selling to lower credit car buyers. They came out with a $220 million dollar issue as an Asset Backed Security offering. What that means is that the assets backing the offering are the outstanding loans to their customers. The sale of the investment grade portion of the loans went fine, however the sale of the below investment grade loans had no buyers. This is the “canary in the coal mine” indicator of trouble ahead. I subscribe to text messages from a source called The Car Guy. He is a dealer in the car business and gives me insights on the auto industry. Last year he predicted that this year would be the year of auto loan defaults. As the lower end consumer gets squeezed by wages not keeping up with inflation for 24 straight months, those car buyers will start defaulting on their loans. This is just one indication that the economy is starting to get in trouble. Another sign that the economy is slowing is the demand for industrial chemicals and metals. Last month the aggregate price of industrial chemicals and metals was down around -15% from the previous month. Just a few examples were Urea Ammonia -32.5%, Rhodium -10.8%, nickel k-15.9%, and tin -16.8%. These were just some examples on a long list. On the housing front, mortgage purchase applications were down from 180,000 to 139,000 last week which shows a slowing in the housing market. In the last few weeks there has been a nationwide drop in housing prices and as long as mortgage interest rates remain high, we will continue to see a decline in housing demand. The money supply (M2) declined again last month to -1.7% from -1.3%. This is the first time in 60 years that the money supply has gone negative which I talked about in a previous letter. What this means is when there is less money in the system, there is less money to spend. There are two events coming up that are not getting much attention as to how they will effect the economy. They both have to do with the consumer having less money to spend and that will slow the economy. The first is, as of today, the SNAP program or otherwise known as food stamps is being cut back by 33% in 32 states. That equates to $95 per person per month for 42 million people. That means that there will be 3 to 4 billion per month or 35 to 50 billion per year not being spent in the economy which is estimated that will lower the Gross Domestic Product (GDP) by 15-20 basis points per year. (One basis point is 1% percent of 1%.) The second is that the Supreme Court had a preliminary hearing yesterday on whether the Biden Administration could forgive 40 million borrowers of $10,000 per person or $20,000 for low income borrowers of student debt. From most people’s readings, the court seemed skeptical of finding in favor of the the loan forgiveness. If that is true, this will certainly tend to slow the economy over the longer term, however, there is a short term issue that will effect the economy soon. The shorter term issue is the fact that the forbearance of loan payments for the last three years on the student debt will expire on September 1st. The average monthly payment for undergraduate borrowers is $235 and $600 for graduate borrowers. I am pretty sure that the resumption of loan payments has probably not been factored into most people’s budgets. This out flow of payments to service the student loans will be taken out the money now being spent in the economy. Finally, the private employment agencies Indeed.com and Zip Recruiter.com are starting to report a decline of demand in the posting of job openings. These figures are much lower than the figures that are being reported by the U.S. government. Remember, employment is the last indicator to show that we are going into or are already in a recession. Think about it this way, most employers will hold onto good employees for a long as possible. It is expensive to hire and train a new employee, plus no employer wants to layoff anyone unless they have to. This lower demand for new employees is a start of a trend towards coming layoffs as the economy slows.

Last week’s Fed meeting

QUOTE OF THE WEEK “The only person you are destined to become is the person you decide to be.” TECH CORNER Last week the equity markets were pretty much flat with the S&P 500 -0.20%, the Dow up+ 0.02%, and the Nasdaq up +0.63%. What was telling was that the markets started the week up, and then on Thursday and Friday the markets started a deep dive and have continued down again today (Tuesday). I think the reality of the Consumer Price Index Report from last week showed that the Fed has a lot more work to do to get to their target of 2% inflation. In last week’s letter I quoted a lot of statistics from the report so I won’t go into them today. But it doesn’t look like the recent interest rate increases from the Fed are having the desired effect to lower inflation. The Fed has said that more increases are on the way and they will probably keep interest rates high through the rest of 2023. The big event this week is the release of the minutes from last week’s Fed meeting. That will tell us a lot about what the Fed is planning for interest rates. If they come out “hawkish”, meaning they plan to keep raising rates and keeping them high, the equity markets won’t like it. Right now the equity markets are hoping for the elusive “soft landing”. If the Fed is “hawkish”, the chance of a “soft landing” will fade quickly. TOM’S THOUGHTS What Is Probate? Probate is one of those terms that is frequently used without people understanding what it is. The following article from Broadridge provides a short explanation. Enjoy. When you die, you leave behind your estate. Your estate consists of your assets — all of your money, real estate, and worldly belongings. Your estate also includes your debts, expenses, and unpaid taxes. After you die, somebody must take charge of your estate and settle your affairs. This person will take your estate through probate, a court-supervised process that winds up your financial affairs after your death. The proceedings take place in the state where you were living at the time of your death. Owning property in more than one state can result in multiple probate proceedings. This is known as ancillary probate. How does probate start? If your estate is subject to probate, someone (usually a family member) begins the process by filing an application for the probate of your will. The application is known as a petition. The petitioner brings it to the probate court along with your will. Usually, the petitioner will file an application for the appointment of an executor at the same time. The court first rules on the validity of the will. Assuming that the will meets all of your state’s legal requirements, the court will then rule on the application for an executor. If the executor meets your state’s requirements and is otherwise fit to serve, the court generally approves the application. What’s an executor? The executor is the person whom you choose to handle the settlement of your estate. Typically, the executor is a spouse or a close family member, but you may want to name a professional executor, such as a bank or attorney. You’ll want to choose someone whom you trust will be able to carry out your wishes as stated in the will. The executor has a fiduciary duty — that is, a heightened responsibility to be honest, impartial, and financially responsible. Now, this doesn’t mean that your executor has to be an attorney or tax wizard, but merely has the common sense to know when to ask for specialized advice. Your executor’s duties may include: The probate court supervises and oversees the entire process. Some states allow a less formal process if the estate is small and there are no complicated issues to resolve. In those states allowing informal probate, the court may be involved only indirectly. This may speed up the probate process, which can take years. What if you don’t name an executor? If you don’t name an executor in your will, or if the executor can’t serve for some reason, the court will appoint an administrator to settle your estate according to the terms of your will. If you die without a will, the court will also appoint an administrator to settle your estate. This administrator will follow a special set of laws, known as intestacy laws, that are made for such situations. Is all of your property subject to probate? Although most assets in your estate may pass through the probate process, other assets may not. It often depends on the type of asset or how an asset is titled. For example, many married couples own their residence jointly with rights of survivorship. Property owned in this manner bypasses probate entirely and passes by “operation of law.” That is, at death, the property passes directly to the joint owner regardless of the terms of the will and without going through probate. Other assets that may bypass probate include:

Markets fighting the bad economics news

QUOTE OF THE WEEK “One way to get the most out of life is to look upon it as an adventure.” – William Feather TECH CORNER Last week the equity markets declined with the S&P 500 down -1.07%, the Dow down -0.11% and the Nasdaq down -2.37%. This week as of Thursday, the markets are pretty much flat. The markets are really fighting the bad economics news far better than I expected so far this year. They are factoring in a soft landing for the economy. Based on what I see in the data, the odds of that happening are extremely low. The big news this week was the Consumer Price Index Report (CPI) for January. The headline CPI was up +6.4% (Y/Y) year over year. The unexpected print was the (M/M) month over month +0.5%. Core CPI which takes out food and energy was up +0.4% M/M and up +5.6% Y/Y. Shelter was up +0.7% M/M and accelerated to +7.8% Y/Y. Services ex-Shelter was up +0.6% M/M and +7.2% Y/Y. I can go on with more statistics on the inflation report, but you get the picture. The Fed has a long way to go to get inflation down to their target of 2%. The Fed in its announcements has been especially hawkish in saying that they are going to continue to raise rates and once they stop raising rates they will keep rates high until they reach their goal of 2% or something breaks in the financial system. Please believe them that they will do what they say. They are not going to ease off too early as past Feds have done and have inflation come roaring back. The markets I think are delusional in thinking the Fed will pull off a soft landing. All the economic indicators are pointing down at an increasing rate. They have reached the point where in the past they have been a precursor to a recession. Whether it is a shallow recession or a deep recession we will certainly have a deep corporate earnings recession which will lead to lower stock prices. It happens every time. LARRY’S THOUGHTS I found this interesting chart showing the Interstate Migration Trends for 2022. It is pretty much what I expected. The movement is away from high income tax states to low or no income tax states. There also seems to be a movement from cold weather states to warm weather states.

Are we are headed for a recession?

QUOTE OF THE WEEK “The size of success is measured by the strength of your desire, the size of your dream, and how you handle disappointment along the way.” – Robert Kiyosaki TECH CORNER There was no letter last week. I was waiting for the results of the Fed meeting and by the time I wrote the letter it was too late to get it out by Friday. The Fed met last week and raised the interest rate by 1/4 of a percent as expected. Speaking at the Economic Club of Washington D.C, Chairman Powell reiterated his comments from last week where he said that we can expect further rate increases going forward. He said it is going to take quite a bit of time and it is not going to be smooth to get inflation down to the Fed’s 2% target and did anticipate that the Fed will keep interest rates high for the rest of 2023. After December’s market decline we have had a nice little bear market rally with the S&P 500 up +7.86% and the Nasdaq up +14.77%. This is not unusual for a bear market rally. During the bear market of 2000 to 2002 there were 11 bear market rallies with one rally of +49%. The markets seem to think that the Fed will back off soon due to inflation dipping slightly over the last quarter but I am of the opinion that the Fed will do exactly as they said they will and keep raising rates and keeping them high for a long period. Chairman Powell has said that the economy can’t thrive with a 4% or 5% inflation rate imbedded for the long term. Under the covers there are many things going wrong with the economy and the trend is definitely going in the wrong direction. The ISM Manufacturing Index just went into contraction mode with a print of 47.40. Any reading less than 50 is contracting. I want you to pay special attention to the rate of change downward of the ISM Manufacturing Index. It doesn’t look like it is anywhere near the bottom. The ISM Manufacturing New Orders Index is also headed straight down. Every time the New Orders Index has printed below 42 we have had a recession. The Leading Economic Indicators (LEI) which is a forward indicator of the economy has been down for seven consecutive months. A recession has commenced in every prior instance in which LEI has been negative for 6 straight months. The press has been talking about how the consumer is in good shape and still spending. On an inflation adjusted basis that is not true. Inflation has caused the cost of living to rise which leads to lower consumption capacity meaning companies won’t sell as much stuff. That means revenues are going down and with wages going up that puts a squeeze on corporate profits. So far 262 of the 500 companies of the S&P 500 have reported earnings for the fourth quarter of 2022 with earnings are down -3.58% so far. That percentage includes Energy being up +68.97%. If you exclude Energy the number looks really bad. Another factor is that Liquidity in the monetary system is drying up. If there is less money in the system, there is less money to buy stuff from companies, thus lower profits. For the first time since 1960 the growth of the money supply went negative in 2022. Take a look at 2020 and 2021 when the money supply went up +24.84% and +12.37%. The stock market did quite well. Now look at 2022 when the money supply was negative -0.64%, the markets crashed. I could go on and on with statistics but you get the picture. We are headed for a recession and it is already baked in because of the direction of the rate of change of the data. We are currently positioned in a Money Market fund in order to avoid the coming recession. At some point in time if history is an indicator we will be moving to U.S. Treasury Bonds as longer term interest rates start to decline. Remember bond prices go up when interest rates decline. KATHY’S THOUGHTS Many of us can be unsure of what to keep and for how long to keep records and so I thought with tax season upon us, I would share this information with you as a refresher. Record Retention: Deciding Which Financial Records to Keep Keep critical documents and records safe and secure but accessible in a time of need Certain documents and records are too important to retain in an ordinary file drawer. Fortunately, they are also the ones you tend to need least frequently. If they are stolen or destroyed by a catastrophe such as flood or fire, replacing them could be extraordinarily difficult, if not impossible. One of the best places to retain such items is a safety deposit box. These can be rented for a small monthly fee at many banks. The boxes are actually locked drawers within the bank’s vault. Various sizes are often available to meet individual needs. A home safe is another option, provided that it is adequately rated to protect contents from fire, water, explosions (gas leaks), and other calamities. Documents deserving extra protection include: Keeping copies of vital records can save time, money, and headaches There may be times when you need to know certain information contained on documents you’ve placed in safekeeping but don’t need the actual document. Avoid the inconvenience of obtaining the original documents by making copies of them for your file. Tip: Create one file that includes copies of all documents you’ve placed in safekeeping (e.g., a “Safety Deposit Box” file). Then, you not only can turn to it for vital facts, but if you are incapacitated, whoever handles your important affairs will be able to locate key documents quickly. Caution: The specific contents of some documents, such as wills and trusts, may be inappropriate to keep in more

IRA Contribution Limits

So far this year, as of this writing, the S&P 500 is up 3.2% YTD and the Nasdaq is up 6.1% YTD but the Bear Market is not over…

Bear Market Is Not Over

So far this year, as of this writing, the S&P 500 is up 3.2% YTD and the Nasdaq is up 6.1% YTD but the Bear Market is not over…

Equity Markets Have Held Steady For The 4th Quarter

The year has started off well for the equity markets. Last week the equity markets were up between 1% and 2%…

Economic Indicators Are Much Clearer

The economic indicators are much clearer this year than last year. With the addition of Omega Squared as our new advisor…

Volatility Spiking

We are still in Quad IV and getting deeper with the trend declining. Because of the strength of the downward trend, it looks like this trend should continue for a few more months. Of course, trends could change but the math doesn’t see that happening any time soon.

Social Security Survivor Benefits

However, no one needs more than 40 credits (10 years of work) to be “fully insured” for benefits.

The Decline

In other words, growth and inflation slowdown are imminent, and we can expect a deep Quad IV in the second quarter of 2022, whether you like it or not.

Quad 4

We are starting to see the signs of Quad IV coming down the tracks now.

Inheritance?

As much as we would appreciate a normal distribution of stock price returns, that’s just not how the stock market game works.

PVV

The three factors are Price, Volume, and Volatility with Volatility being the most important.

Inflation

We will soon start having some headwinds as people on unemployment and getting the extra $300 per month will soon lose the $300.

Infrastructure & College Funding

We don’t see a change in the Quads coming soon so it looks like smooth sailing for a while.

More on Housing

Yet, the number of initial jobless claimants remains at 16 million or roughly ten times the 1.7 million job unemployment claimants in January 2020.

Taxation of Investments

This rapid increase in housing prices may moderate going forward.

Grocery Prices Apocalypse

The inflation issue comes down to exceedingly low inventories and increased demand due to the public “getting out of jail” with lots of money in their pockets